Housebuilder Bovis Homes (BVS) admits paying cash incentives to customers to complete on house purchases before the end of the year. The company was clearly desperate to hit its sales targets but ultimately failed to do so.

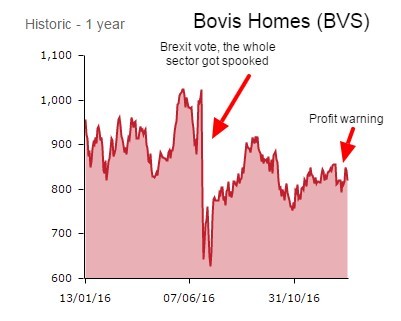

That sparked a profit warning on 28 December as the company realised it would complete 180 fewer homes than expected in 2016. Pre-tax profit is now guided at £160m to £170m against the previous consensus forecast of £183m.

Today's revelations act as another drag on the share price, down 2.6% to 820.5p, and follows the departure of chief executive David Ritchie on 9 January after 18 years at the business.

June's big share price sell-off was unconnected, coming in the wake of the EU leave vote victory.

CUSTOMERS OUTRAGED

A sickening twist for shareholders from this debacle is the damage done to the company's brand. Many customers who accepted the incentives have since complained about unfinished and defective homes and some plan to protest at the group’s AGM in May.

This could well hit the company's competitive position and ultimately constrain future growth potential.

In our view Bovis is an example that shows the folly of companies that slavishly obsess about short-term growth targets. A successful business builds a strong competitive position from which it can deliver sustainable growth over the long-term, not live by the sword of a bi-annual reporting schedule.