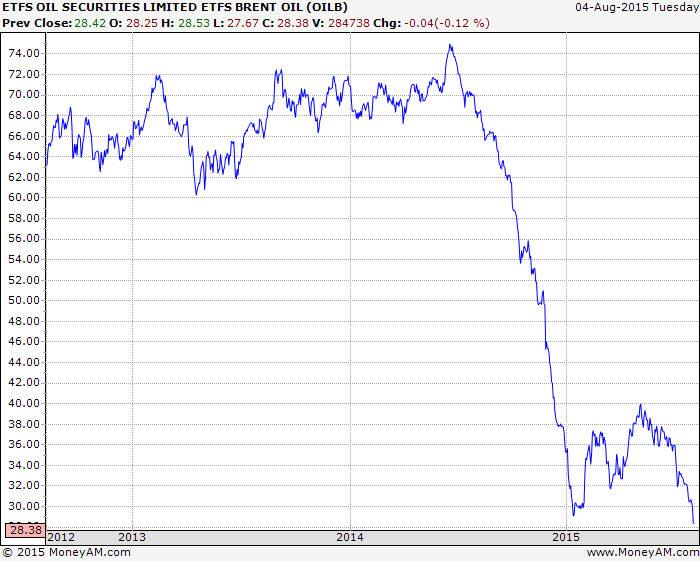

Brent crude is trading around $50 per barrel, briefly slipping below this psychologically important level on Monday (3 Aug). Any hopes of a short-term reversal look limited for the European market's oil benchmark. It is ‘difficult to see what prompts a near-term reversal,’ says analysts at Deutsche Bank.

Brent had topped $70 intra-day in early June (5 Jun) but is now much closer to its mid-January lows of $46 per barrel. Shares explored the likely floor for the oil price in this in-depth feature.

Deutsche notes that although US Energy Information Administration data shows supply from the country's four big shale oil plays has fallen 100,000 barrels of oil per day since April, a ramp up in Iranian exports from late 2015 could offset the benefit from US declines.

Since 2010 Brent has typically traded above its US counterpart West Texas Intermediate (WTI) but Bank of America Merrill Lynch reckons this situation will reverse in 2016.

It says: ‘Higher Middle East output combined with declining drilling activity in North America could reverse WTI-Brent dynamics in 2016.’ Explaining that as shale output drops US refiners may have to import crude to keep up with demand for gasoline and that, in turn, WTI will have to trade above Brent in order to attract imports into the US.