Online fast fashion retailer Boohoo (BOO:AIM) upgrades its full year sales growth guidance after generating bumper sales over a Christmas period which proved a brutal time for many rival UK clothing purveyors.

Manchester-headquartered Boohoo’s raised guidance stands in stark contrast to pure play online peer ASOS (ASC:AIM), still reeling from a punishing profit warning in December where it cut annual sales growth guidance, citing a fall in consumer confidence and a flurry of margin-eroding discounts.

BOOHOO RAISES SMILES

For the four months up to and including New Year’s Eve, Boohoo, which sells clothes, shoes and accessories to young, price-conscious shoppers, generated strong sales growth of 44% driven by all brands in all geographic regions.

UK sales were up 33% to £180m, Rest of Europe revenues rose 57% to £44.4m, Rest of World sales grew 35% to £33.4m and the USA was the star performer, sales shooting 78% higher to £70.4m.

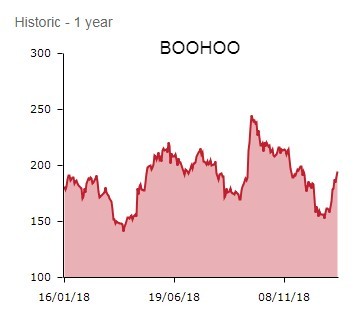

Admittedly the eponymous Boohoo brand’s sales grew 15% to £163.5m, undershooting consensus expectations for £167m and perhaps explaining today’s 3.3% share price decline to 188.1p.

Yet the growth delivered from two brands acquired in early 2017 was rapid.

Vibrant fashion brand’ PrettyLittleThing’s revenues almost doubled to £144.2m, important given that PrettyLittleThing’s gross margins are higher than Boohoo’s, while ‘free-thinking brand’ Nasty Gal’s sales strutted 74% higher to £20.6m.

A standout metric for the four months was gross margin, up 170 basis points to 54.2% reflecting Boohoo’s improved effectiveness and timing of its promotional activity which drove record Black Friday sales.

Boohoo also closed the period with £189m net cash in the coffers, providing ample firepower for investment in its customer proposition, infrastructure to support global growth and potential acquisitions.

Buoyed by its very Merry Christmas, Boohoo is now guiding to revenue growth of between 43%-to-45% for the year to 28 February 2019, ahead of its previously guided 38%-to-43% range.

Adjusted EBITDA margins are expected to be between 9.25% and 9.75%, ‘narrowing the range from the 9% to 10% as previously guided’.

Joint CEOs Mahmud Kamani and Carol Kane are ‘delighted to be reporting yet another great set of financial and operational results’ and remain ‘firmly focused on continuing to provide our customers with great fashion at unbeatable value.

'The global growth opportunity is significant and we will be addressing it in a controlled way - investing in our proposition, operations and infrastructure to capitalise on the opportunity.’

THE EXPERTS HAVE THEIR SAY

Russ Mould, investment director at AJ Bell, comments: ‘The retail sector is alive and well if your name is BooHoo. The company has proven it is possible to keep growing sales and, importantly, push up profit margins.

‘BooHoo is certainly among the winners of the latest round of retail updates with stellar growth rates and upgraded future earnings guidance.

‘The reality is that people are still spending money; they are simply being more picky about with whom they shop. BooHoo is very much “in fashion” in terms of having the right styles to appeal to younger people and its marketing seems to be very effective.

‘It is also able to swiftly introduce new designs thanks to a fast-fashion model which involves testing new concepts and quickly producing the ones that have the best response from customers.

‘This is basic retailing - give people what they want and in an efficient manner. You might think that’s obvious and everyone does it, but the reality is that many well-known retail companies fail on so many basic measures.’

Liberum Capital sees recent weakness as ‘an opportunity to pick up the shares a lot cheaper’, insisting ‘Boohoo continues to outperform, delivering another set of excellent results today. Management has upgraded sales growth guidance range for full year 2019 to 43-45%.

'This has been driven by an outperformance at PrettyLittleThing and continued momentum at Boohoo and Nasty Gal.’

Shore Capital is also bullish, arguing ‘Boohoo is “the one” to own in the quoted online UK fast fashion scene.’ Furthermore, the broker insists Boohoo’s performance ‘sets the business apart from the other pure-play apparel players in the UK.

'In a remarkable turn of fortune the sub-sector has witnessed a nasty downturn in recent times with a quite remarkable, surprise and structural, profit warning from Asos but also substantial losses recorded by seemingly missguided Missguided and yet another warning from Quiz (QUIZ:AIM), also leading to a collapse in its share price and returns for investors in the IPO.'