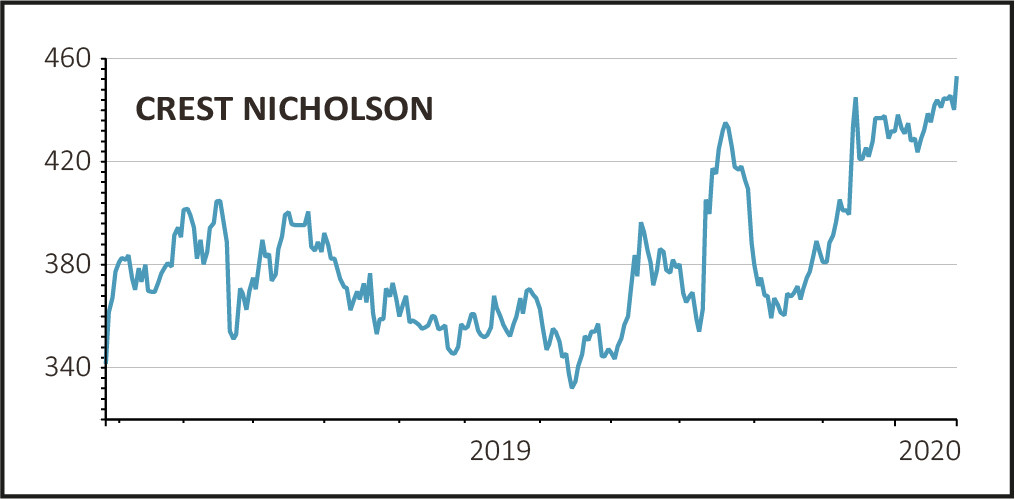

Shares in Crest Nicholson (CRST) advanced 3.4% to 455p as it announced its full year results and outlined its recovery plans.

The housebuilder reported a fall in profit as it sold fewer homes at lower prices amid a shift in focus to more affordable housing.

For the year to 31 October, pre-tax fell to £102.7m from £168.7m year-on-year as sales slipped to £1.09bn from £1.12bn amid a 4% decline in completions to 2,912 homes.

Under CEO Peter Truscott who took over in September 2019, the company has outlined its turnaround strategy through to 2022.

This includes a plan to increase completions to 3,500 units, boost return on capital employed from 15.9% to 20% and to improve the current operating margin of 12.2% by 250 basis points by the current 12.2%.

The dividend per share will be maintained at 33p per share for 2020 and increase in line with inflation thereafter.

AJ Bell investment director Russ Mould says: ‘Crest is a high end operator, a large proportion of its new builds are ineligible for Help to Buy support, and it has a strong bias to the south east of England. As such it has been caught out by dwindling demand in this part of the market.

‘The company is trying to move towards selling more affordable homes, but this is likely to take time and arguably it doesn’t have the scale or expertise to compete with rivals for whom this part of the market is a more natural fit.

‘Perhaps surprisingly the dividend is being maintained, with plans to increase it in line with inflation from 2021.

‘Investors may wonder if Truscott has missed a trick here. Early in his tenure he probably would have had the room to reduce the payout in order to boost investment in a turnaround of the group.’

Liberum analyst Charlie Campbell says: ‘This is the new CEO’s first opportunity to share the strategy for recovery. We find the first target of recovering margin by at least 250 basis points by 2022 to be a little disappointing, as Crest’s margins are almost 1,000 basis points behind the sector average.’