Social care services provider CareTech (CTH: AIM) has delivered strong results through organic growth and bolt-in acquisitions.

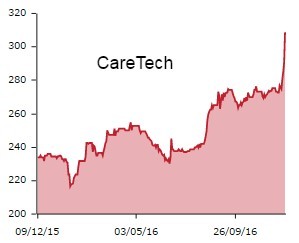

Shares in the social care services provider have increased by nearly a third in value since the Brexit vote in June, with the stock trading a further 5.5% higher at 307p off the back of its latest financial results.

Its underlying pre-tax profit increased from £22m to £26.1m in the year to 30 September 2016.

Overall turnover has risen by nearly a fifth from £124.3m to £149m, while the full year dividend has been hiked by 10% to 9.25p per share.

CareTech’s residential services division for young people has performed particularly well, as revenue is up from £22.5m to £39m over the same period.

It has been supported by the acquisitions of domiciliary care provider ROC Northwest and residential care provider Sparks of Genius.

Canaccord Genuity analyst Samuel Hosseini is upbeat with a ‘buy’ recommendation and believes the company is steadily growing through bolt-on acquisitions and property development.

He notes the foster care division is an area of financial weakness as sales have declined from £9.8m to £8.7m due to local authorities using more in-house foster care instead of outsourcing.

CareTech’s mental health division also saw a decline in revenue from £6.4m to £5.7m as several services were reconfigured and transferred to adult learning disabilities.

The firm’s acquisition of Oakleaf Care in March has helped earnings before interest, tax, depreciation and amortisation (EBITDA) rise in the adult learning division from £24.5m to £26.4m.

Panmure Gordon analyst Julie Simmonds believes the acquisition of eight facilities for children’s services is expected to drive further revenue growth next year with improved profitability from 2018.