Gold producer Centamin (CEY) implies a new law in Egypt could result in the dismissal of a legal case questioning its right to operate the Sukari gold mine. Investors understandably like the news, sending the share price up 9.3% to 61.17p. It is very encouraging but this remains a risky stock as the legal matter is not yet concluded and political instability is still a problem.

Centamin has been fighting a court case since October 2012 brought by Hamdy El Fakharany, a lawyer and former member of parliament who has had previous success with similar asset ownership challenges in the property space. He has challenged the Egyptian government over the way in which the original licences were awarded for Sukari. This Q&A from Centamin provides further details on the court case.

Today's announcement highlights a new investment law which restricts third parties from challenging contractual agreements between the Egyptian government and investors. The new law appears to apply to both new and respective legal cases. Effectively that should free Centamin of the legal battles that have weighed heavily on its market valuation.

While the signs look good for Centamin, hence the big share price movement today, the matter has not officially been concluded. Nonetheless, analysts remain optimistic.

Stockbroker Numis says: 'While by no means certain this could well squash the legal case and remove the stone around Centamin's neck.' Goldman Sachs comments: 'The overhang on Centamin (regarding the ongoing challenge in relation to the Sukari concession agreement) has been removed. We see today's announcement as a big positive for the stock.'

Westhouse Securities says: 'It is obviously positive news for the company, and reinforces our belief that the company is likely to win its appeal. However, until the challenge is removed we are retaining our 18% discount rate on the stock.'

Egypt is in the middle of a presidential election campaign with the vote taking place in late May. Various gulf states want to put money into Egypt but are nervous about the political instability, hence why there is pressure on the country to have firmer legal agreements for investors.

Centamin keeps having its court case delayed; it is now expected in October. Assuming that event still happens, a final decision may not be made until mid 2015.

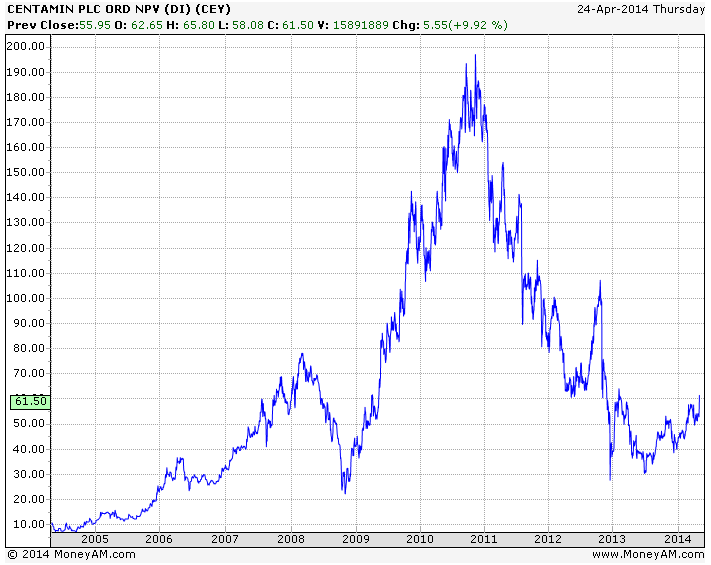

If the ruling is made in Centamin's favour, we expect a significant re-rating in the share price as the market once again returns its focus to the actual mining operations. At its peak in 2010, the shares hit 190p. While there's obviously been a reduction in the gold price since that time, production levels have significantly increased - this year the miner expects to produce 420,000 ounces of gold.