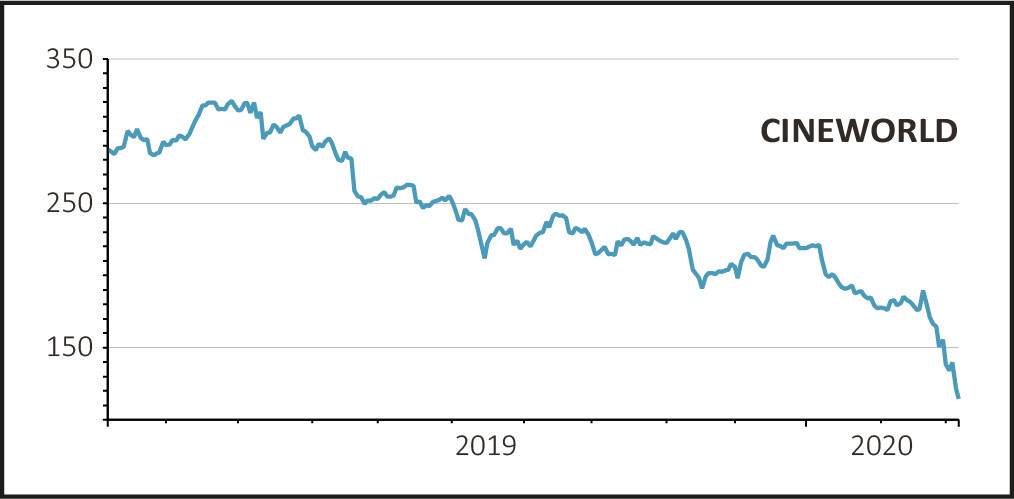

Shares in cinema operator Cineworld (CINE) dropped 8% to 111.7p despite updating the market ahead of its scheduled full-year results on 12 March, saying ‘thus far, we have not observed any material impact from Covid-19 on our admissions.’

The shares are down 45% over the last three-months and 60% over the last year. Even before the outbreak of Covid-19 investors were becoming concerned about the mounting debts at Cineworld following its $2.8bn (£1.6bn) offer to buy Canadian cinema company Cineplex, potentially increasing net debt to $4.19bn.

Shareholders approved the deal on 11 February.

NO TIME TO DIE

The release of the latest James Bond movie has been postponed until November in the UK due to the closure of cinemas in Asian markets, although the studios have reassured Cineworld that they remain committed to their release schedules for the coming months.

In addition, management reported they have seen an increase in admissions in the first two months of the year compared with last year. Cineworld continues to ‘see good levels of admissions in all our territories, despite the reported spread of Covid-19.’

REVENUE MISS, EARNINGS BEAT

Cineworld revealed full-year revenues to 31 December 2019 of $4.4bn, around 2% below the number expected by analysts and adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) of $1bn, slightly ahead of consensus, according to Refinitiv data.

However investors will be more interested in management’s views and outlook for the rest of 2020, especially in light of the Italian government closing cinemas and suspending public events across the country.

The firm said it has measures at its disposal to reduce any impact on its business, including postponing capital expenditure and reducing costs.