The debate over the privatisation and proposed £3 billion flotation of Royal Mail rumbles on amid suggestions ordinary punters will miss out on the opportunity to invest once staff and institutional investors have taken their slice.

This may not be a repeat of the 'Tell Sid' campaign which encouraged the public to buy shares in British Gas in the 1980s but there have been a succession of floats to whet the appetite of UK investors in 2013 and new research from PriceWaterhouseCoopers (PwC) suggests London has led the way in the European IPO market so far this year.

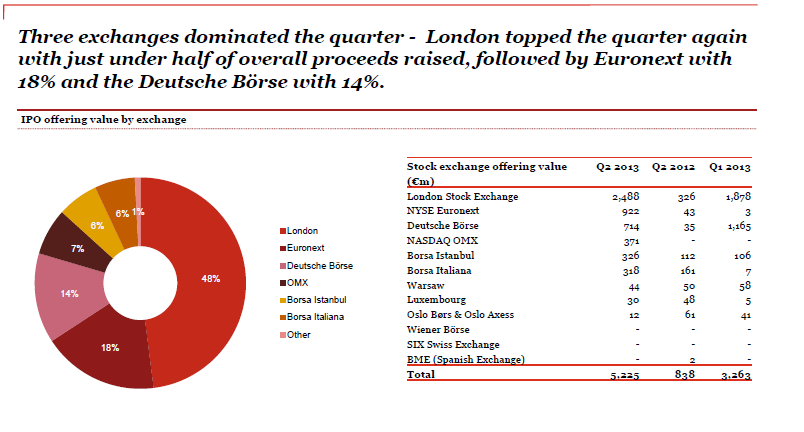

The PwC Q2 2013 IPO Watch Europe Survey shows primary market activity in Europe reached its second highest quarterly level since the end of 2011 with just under half of the total proceeds of ?5.2 billion for the quarter raised in London.

The UK's capital also hosted 33% of the quarter's transactions with an average offering value of ?100 million.

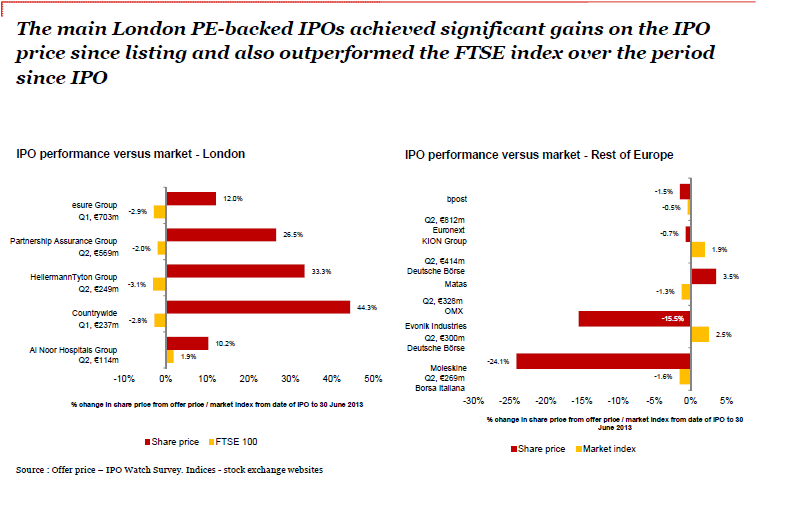

The top 10 IPOs accounted for more than 80% of proceeds in the quarter, seven of which were backed by private equity. As the chart below shows, in 2013 as a whole the main London private equity-backed IPOs have achieved gains well ahead of the performance of the FTSE 100 and much better than those in the rest of Europe.