The mining sector has taken a big hit from a collapse in copper prices, down approximately 10% over the past few days, 7% since yesterday to $5,500 per tonne ($2.50 per pound). The market has been spooked by changes to the global growth outlook and potential disruption to demand in China. The following share price movements are recorded in early trading on the stock market (14 Jan):

Kaz Minerals (KAZ) -15% to 195.9pAntofagasta (ANTO) -9.9% to 638.5pGlencore (GLEN) -8.4% to 246.28pAnglo America (AAL) -8% to £10.53First Quantum Minerals (FQM) -6.7% to 732.25pBHP Billiton (BLT) -5.7% to £12.79Rio Tinto (RIO) -4.9% to £27.75The World Bank has lowered its 2015 global growth forecast to 3% from 3.4%. Copper is a bellwether for the global economy. The World Bank expects 'continued soft commodity prices and weak global trade' as the 'Euro Area and Japan are struggling to recover and a carefully managed slowdown is underway in China', notes Canaccord Genuity in a note on the copper sell-off.

Copper is a major source of revenue for most of the big miners on the stock market. The outlook was already poor given plenty of supply - as we discussed in our recent look at commodity prices. But now there's two new catalysts to weigh on the base metal valuation.

In addition to the World Bank, media reports in China suggest the government could stop supporting troubled small to medium-sized businesses, the impact potentially being defaults in the manufacturing sector - thus negative read-across to copper demand.

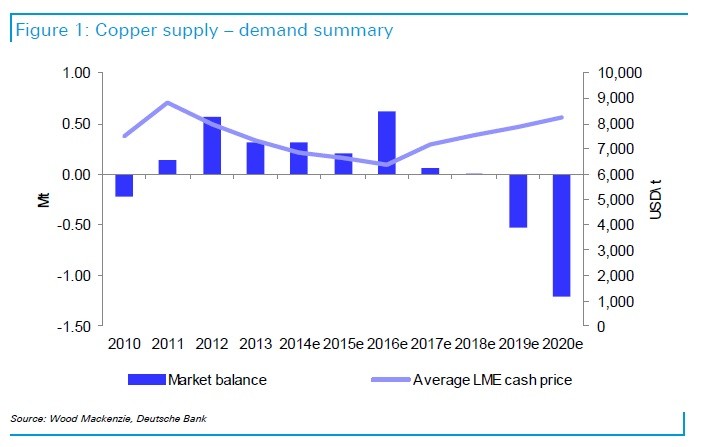

In a detailed look at commodity prices, published last week, Deutsche Bank says the copper market remains 'well to oversupplied' for the next two years. It says the key themes for the base metal in 2015 are:

Will Chinese demand fall sharply due to a lag effect from the property market downturn? The bank reckons global copper demand will be 1% lower in 2015 because of this effect.Will mined supply growth continue to disappoint? Deutsche's view is most likely but not to the extent that will cause a deficit market.Who will win the tussle between those market participants 'shorting' copper and the SRB (State Reserves Bureau), which seems to be intent on providing support?How dynamic is the copper cost curve? Deutsche believes marginal costs will come down, but not nearly as much as in some of the other metals.(Main image courtesy of Anglo American)