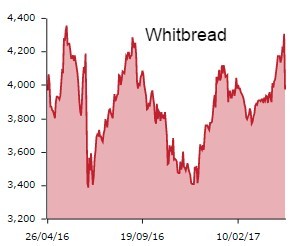

Investors are fretting about underwhelming sales numbers and a gloomy outlook for Whitbread's (WTB) coffee chain Costa Coffee and budget-friendly hotel brand Premier Inn, causing the stock to fall 8% to £39.64.

Costa's sales rose by 10.7% in the year to 2 March 2017 - materially slower than the 15.9% growth seen in the March 2016 financial year, while like-for-like growth in the UK slowed from 2.9% to 2%.

Whitbread has been grappling with higher costs and weaker operating margins.

Chief executive Alison Brittain expects a tougher consumer environment than last year.

Berenberg analyst Stuart Gordon says Costa has missed its revenue forecast of £1,23bn by approximately £25m thanks to the slowing like-for-like sales in the UK.

Consumers appear to be tightening the purse strings on discretionary spending on the high street as inflation starts to bite.

Despite the underperformance, Gordon believes Premier Inn and Costa can deliver solid growth in the medium term.

Credit Suisse analyst Tim Ramskill is also willing to overlook the disappointing performance and guidance as he believes the hotel chain has good momentum that is likely to continue through the summer.

He says the outlook for Premier Inn is robust thanks to positive UK trends and flatter margin guidance, but is more concerned about Costa’s performance.