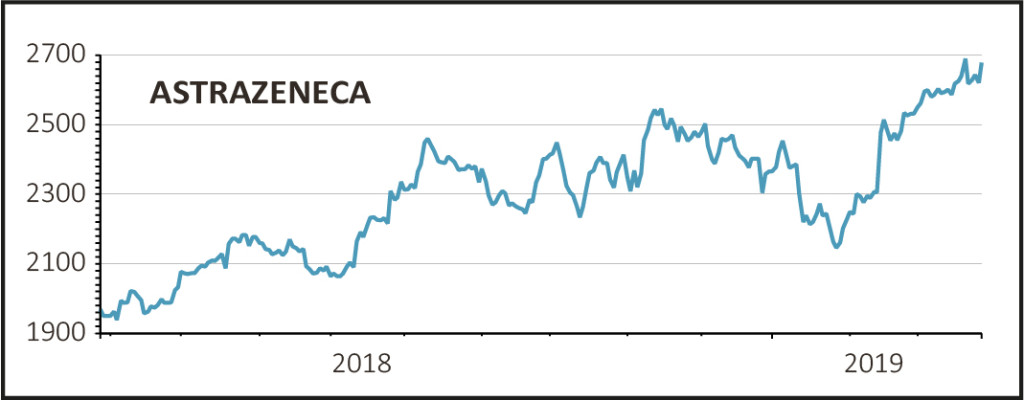

Pharmaceuticals giant AstraZeneca (AZN) falls 4.5% to £62.05 on news of a $6.9bn agreement with Japan’s Daiichi Sankyo to develop and sell the latter’s breast and gastric cancer treatment.

The deal is being part-financed with a $3.5bn share placing which will also be used to repay bonds and to bolster the balance sheet.

The company is pledging to stick with a progressive dividend policy, but some observers are not so sure this will be sustainable in the longer term. AJ Bell investment director Russ Mould says: ‘While that will be a relief to shareholders, one should still be aware of the risk to future dividends if AstraZeneca has regained its appetite for mega deals.’

Mould explains the backdrop to the deal. ‘Large pharmaceutical companies have been racing to replace declining sales from previous blockbuster drugs which have suffered from the loss of patent protection. Cheaper generic drugs offered by rivals have caused companies like AstraZeneca and GlaxoSmithKline (GSK) to trip up.’

READ MORE ON ASTRAZENECA HERE

Some investors might legitimately ask why the company is raising funds to repay bonds at a cost of less than 2% (1.95% to be exact), when equity has a higher cost of capital, or in other words is a more expensive way of funding the business.

But, in terms of the Daiichi transaction announced today at least, broker Shore Capital is impressed. It notes: ‘We view today’s announcement as a positive for AstraZeneca.

'With a relatively small upfront payment ($1.35bn, of which $675m is payable on completion and $675m in 12 months' time), AstraZeneca is gaining access (50%) to an asset (DS-8201) initially targeted at a pre-defined patient population (i.e. breast cancer patients who have failed treatment on other HER2 therapies), but with the potential for use in other cancers including HER2-low expressing tumours for which there are no alternative therapies.’