Ofgem continues its get tough policy over UK energy networks with National Grid (NG.) the latest operator to come under pressure.

Shares in the UK’s largest utility company have slumped more than 4% to 801.4p after the UK energy watchdog pitched its latest proposals to cut the cost of energy for consumers.

INVESTORS VS CONSUMERS

Ofgem believes too much cash is flowing into the pockets of shareholders, and wants to pass on greater savings to consumers. To do this the regulator is proposing to roughly cut in half baseline cost of equity returns to 4%, hoping to save British consumers what it estimates to be around £6.5bn.

Ofgem also proposes to ‘keep adjusting the cost network companies face to borrow (cost of debt) annually so that consumers continue to benefit from the fall in interest rates since the financial crisis.’

The worry for investors is that slashing National Grid returns could conceivably cap the group’s dividend-paying capability. This is, after all, the main reason why people own the shares.

‘The consensus analyst forecast is for National Grid to pay 48.9p per share in dividends for the financial year to March 2020, implying a 6.1% yield,’ says AJ Bell’s investment director Russ Mould.

‘One could expect dividends beyond 2021 to potentially be less generous should Ofgem’s proposals be finalised without any amendments.’

INVESTORS PUT CAPITAL AT RISK

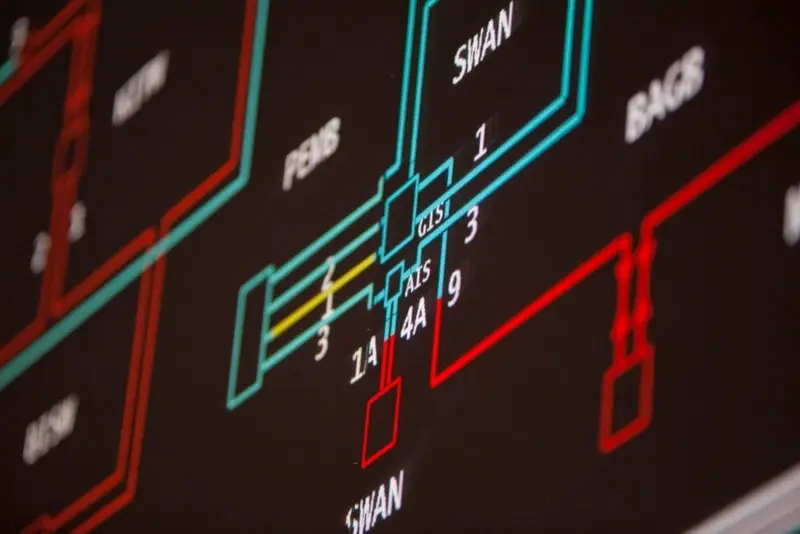

National Grid immediately batted back that such plans fail to appropriately recognise the risk to investors, especially when millions of pounds will be needed in investment to keep transmission networks fit for purpose.

‘In order to deliver the major capital programme required across our networks in a rapidly changing energy market, we need to ensure the regulatory framework also provides for fair returns to shareholders,’ National Grid says today.

The proposals are part of Ofgem’s RIIO-2 framework, or revenue = incentives + innovation + outputs price controls plan.

The RIIO-2 is designed to encourage network operators to meet important criteria:

1) Put stakeholders at the heart of their decision-making process

2) Invest efficiently to ensure continued safe and reliable services

3) Innovate to reduce network costs for current and future consumers

4) Play a full role in delivering a low carbon economy and wider environmental objectives

‘In order to deliver the major capital programme required across our networks in a rapidly changing energy market, we need to ensure the regulatory framework also provides for fair returns to shareholders,’ says National Grid in its response.

ROOM TO MANOEUVRE

Today’s proposals are just that, they are not yet set in stone and National Grid and others will have the chance to put their case over the coming months. The group expects to pull together a detailed response to the consultation in early 2019.

The consultation period runs to the end of June 2019, with the RIIO-2 price controls coming into force from April 2021.

Like this? Read more about National Grid here.