Online dating provider Cupid (CUP:AIM) is nursing a broken heart after full-year results expose the fragility of its finances. Having sold its casual dating websites last year for £45 million, the remaining traditional dating operations look unappealing to investors, sending the share price crashing down 13.3% to 60.28p. The small cap has a turnaround plan, but we see no reason why anyone would want to pick this stock for a dance without a complete makeover.

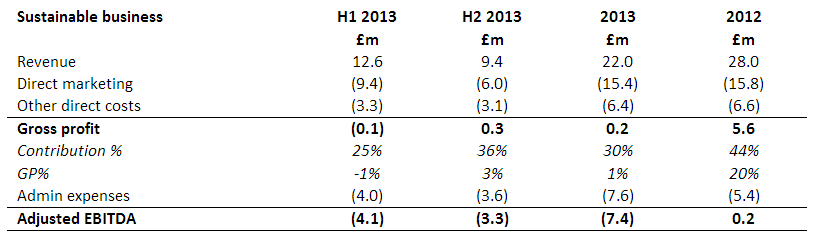

Revenue is falling, there's no dividend growth and the business is now loss making. In fact, the dividend looks unsustainable given the latter point. Management wouldn't give us a straight answer as to whether the dividend would be cut, saying they couldn't forecast into the future, but they do feel confident that cash generation will return in the second half of the year.

The casual dating sites used to have fairly high subscription fees. Cupid also admits that it was cheap to 'acquire traffic' for this racier part of the dating market so it enjoyed good visitor volumes to its websites. Now the casual dating profits have been excluded from the financial results, the remaining businesses look pedestrian. Competition is tough and there's plenty of established brands like Match.com hoovering up customers. Cupid says the lack of growth in 2013 was down to low investment in the business.

Two years ago this was the darling of the stockmarket. Analysts flagged the potential for Cupid's technology platform to support an unlimited number of online dating brands. Monthly subscriptions provided the company with attractive cashflow to pay generous dividends, fund marketing to attract more customers and the money to buy more brands.

A probe into its operating practices took the shine off the shares in 2013 and prompted a management shake-up. Sites like BeNaughty.com were sold and Cupid went into hibernation while it worked on a turnaround plan. That's presented in today's full-year results with the analyst presentation proclaiming 'In 2017 we will be a leading international digital technology company'. That's three years away, so why should investors look at Cupid as it stands today?

The business is pinning its recovery hopes on a mixture of new brands, geographical expansion for existing brands and the return of acquisitions. This slide summarises its three-year turnaround plan. (Click on the image to enlarge).

The over-45s market will be a key target for Cupid with the launch of a new brand in the second quarter called LoveBeginsAt, initially targeting the UK and US. It says there's a big opportunity to grow the Uniform Dating brand overseas, claiming that the US has ten times the market potential as the UK. It will launch a new mobile service in the third quarter, preceding that is the Australian debut.

Although we've yet to see any new analyst forecasts for the stock, any upside potential will only become plausible once Cupid has demonstrated it can revive profit growth and cash generation. On the basis of today's results, there's a big job to do.