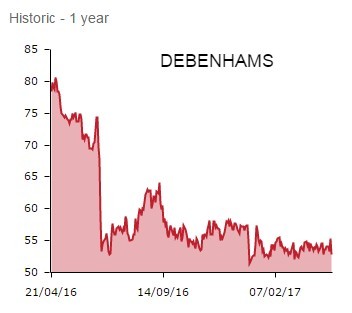

Structurally challenged department store Debenhams (DEB) has delivered a slightly better than expected 6.4% drop in half year pre-tax profit to £87.8m and outlines a three-year plan to turn around its flagging fortunes. So why have the shares fallen 4.3% to 52.95p?

Key reasons for the negative share price reaction are the absence of tangible turnaround targets within the strategy update from new chief executive Sergio Bucher (pictured below).

He reveals the fashion and beauty retailer will need to ramp up spending to revive its growth prospects. That is also taken as a negative factor from the market's perspective.

You can pick through today’s interim results from the embattled British make-up-to-lingerie seller here, highlights including taxable profits of £87.8m, ahead of the £87m consensus estimate.

The company also reported group like-for-like sales up 3% and a year-on-year drop in net debt.

UK operating profits are down more than 11% at £67.5m amid margin and cost pressure, although international profits rose over 12% to £26.4m.

REDESIGNING DEBENHAMS

Investors seem to be more interested on how management are going to fix the business, rather than the historical results.

Bucher’s ‘Debenhams Redesigned’ strategy update reveals a plan to drive growth by becoming a destination for ‘social shopping’ - shopping as a fun leisure activity shared via social media - as well as deliver efficiencies.

That sounds a bit flaky, and the market seems to share our view given the negative share price reaction.

‘Our customers are changing the way they shop and we are changing too,’ insists Bucher.

‘Shopping with Debenhams should be effortless, reliable and fun whichever channel our customers use.

‘We will be a destination for 'Social Shopping' with mobile the unifying platform for interacting with our customers.

‘If we deliver differentiated and distinctive brands, services and experiences both online and in stores, our customers will visit us more frequently and, having simplified our operations to make us more efficient, we will be able to serve them better and make better use of our resources.’

The bad news for long suffering shareholders is Debenhams is now budgeting for higher total capital expenditure of around £150m annually in the three years to full year 2020.

That is up from current annual spend of £130m as Debenhams needs to upgrade its mobile systems, supply chain and store estate.

THE ANALYSTS’ VIEW

Canaccord Genuity duo Sanjay Vidyarthi and David Jeary are holders with a 60p price target. In a morning note headed ‘Right words, no numbers’, they comment:

‘Our sense from an initial read is that he is saying all the right things: focus on digital, 'social shopping', supply chain efficiencies, brand rationalisation, and review of up to 10 stores for closure over the next five years (out of 176).

‘But there are no targets or quantification of return on investment. And there will be investment: capital expenditure guidance is for £150m per annum full year 2018-20E versus a current run-rate of £130m. There will be £50m of exceptional costs, of which half is cash.

‘For a business with a mature UK store portfolio, a 4% group earnings before interest and tax margin and a negative forecast earnings trajectory, more is required before we could turn positive on the investment case.’

‘At first glance the plans look credible but as ever with new management and new strategic ambitions execution of the strategy will be key,’ he says.