The evidence is building to support claims that switching to a cloud computing-based model is a puzzle to which Sage (SGE) does not have an answer.

The accounting and enterprise software supplier to small and medium-sized businesses has again let down investors with slowing organic growth.

In the third quarter to 30 June the FTSE 100 company reported organic revenue growth of 5.3% to £476m.

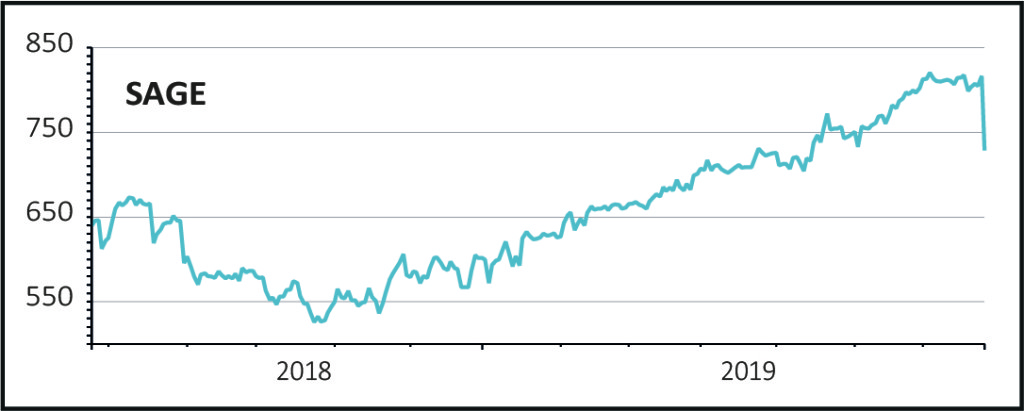

This is a huge blow to investors because it suggest things are getting worse, not better, hence the 12% share price collapse today to £717.8p.

SLOW AND GETTING SLOWER

This is a continuation of the sharp slowdown that has been plaguing Sage for the past few years.

First quarter to 31 December 2018 organic revenue growth was 7.6%, yet by the end of March the pace had eased back to 6.2%.

Running the numbers, analysts estimate that this averages out at 5.9% for the nine months to the end of June, once a few other calculations have been accounted for.

Not so long ago the company was talking about accelerating organic growth with 7% a year the target.

The business also expects organic operating margins to be at the lower end of the guided 23% to 25% range. In the past margins of 27% or so were fairly typical and previous ambitions were to push this towards 30%, on a medium-term horizon.

The financial performance tells us just how fierce a competitive environment this has become - you may have seen the TV ads for Quickbooks, for example, owned by one of Sage’s chief rivals Intuit.

CLOUD CONUNDRUM

The underlying story is really about cloud adoption. Sage has been for years a reliable business built on a license sales model, where most of the contracted cash comes upfront with high margin servicing and maintenance income rolling in over the term of the contract.

Now it finds itself being disrupted. Customers want the applications anywhere, any time and on any device that cloud delivery offers.

Even if users stay loyal to Sage’s own cloud suite, it typically means a big hit to upfront revenue and cash flow, and that drags growth rates down in the short-term, albeit producing a typically reliable subscriptions-based income stream over time.

READ MORE ABOUT SAGE HERE

But there are plenty of ‘born in the cloud’ rivals which have emerged that do not have this legacy problem to address.

So while being squeezed by competition from long-standing competitors like Intuit and Australia’s MYOB, Sage is also under increasing pressure from rapidly-growing start-ups like Kashflow and, in particular, Xero, the New Zealand-founded business.

Managing all of these factors must also be balanced with the needs of shareholders, both in terms of share price performance and dividend payments. That’s a huge challenge for Sage, and one it has so far failed to satisfactorily show it can handle.