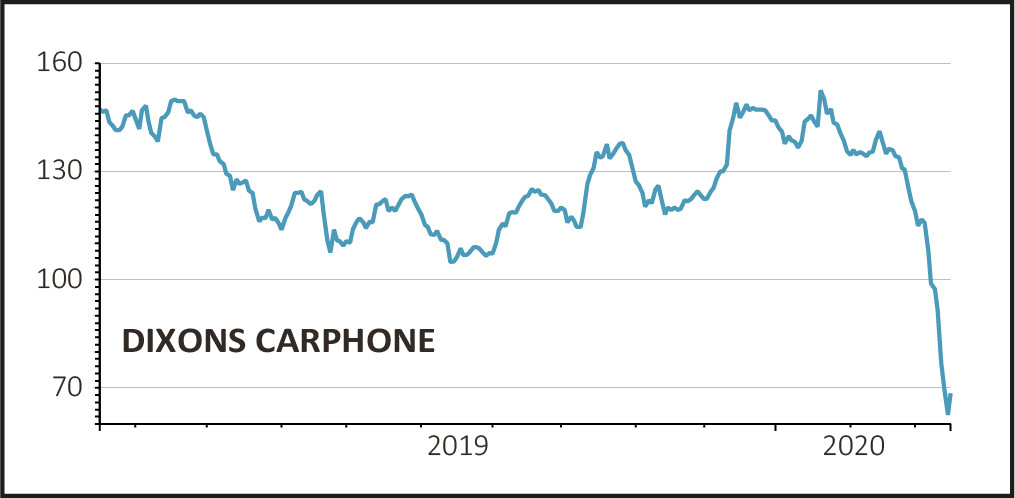

Shares in electrical goods and mobile phone seller Dixons Carphone (DC.) gained 10% to 68.8p after it announced the next step in its turnaround strategy for the UK mobile business.

Given that the shares have more than halved in the last month, today’s bounce is little more than a blip on the chart but the firm deserves credit for grasping the nettle and making tough decisions.

REDUCING STORES

The headline news is that all of the company’s 531 standalone Carphone Warehouse stores will shut from the beginning of April, resulting in the loss of 2,900 jobs. Another 1,800 staff will be offered new roles internally.

With customers replacing their handsets less often and shopping for more flexible bundles, the standalone stores are seeing lower footfall.

In contrast, the shop-in-shop outlets inside the firm’s 300-plus Currys PC World stores are seeing increased traffic and customer satisfaction is up sharply according to the company.

STICKING TO FORECASTS

In a plus for shareholders, the restructuring of the UK mobile business will have no impact on the firm’s medium-term target of delivering over £1bn of cumulative free cash flow by FY2023/24.

In fact, by offsetting the estimated £220m of restructuring costs against lower working capital needs, the mobile business should at least break even by FY 2021/22 although losses are seen at £90m this financial year.

Overall, the firm says it is on track to meet its current-year guidance of adjusted pre-tax profits of £210m, despite a ‘headwind to profit’ at its travel outlets due to coronavirus.

HOME WORKING A POTENTIAL PLUS

Aside from the travel business, trading hasn’t been materially affected by coronavirus. Supply constraints have been limited, and online and in-store electrical sales ‘have held up well across all territories’.

If anything, the need for people to self-isolate and/or work from home has led to ‘notable increases in sales’ of fridges, freezers, small domestic appliances and laptop computers.