Trouble overseas and slower growth in its home UK market means Domino’s Pizza's (DOM) underlying pre-tax profit in 2018 is now expected to come be at the lower end of its £93.9m to £98.2m guidance range.

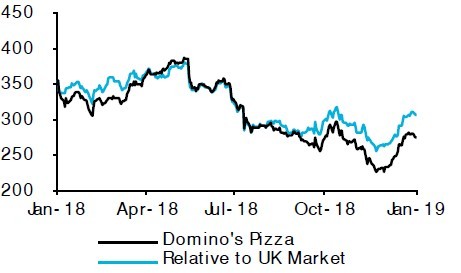

Shares in pizza delivery chain have slumped 7.6% to 253.1p in morning trade on Tuesday.

Domino’s integration of the operations in Norway it bought in 2017 has been far from smooth, while weather challenges are blamed for weaker sales in Switzerland, Iceland and in part of Scandinavia, Norway and Sweden. The business now anticipates its International operations to run-up losses of between £3m and £4m for the year.

This is not the first time that the company has blamed the weather for slower trading. It did just that when trying to explain disappointing UK like-for-like sales growth during the extreme summer heatwave in Britain last year.

‘There is probably a lesson in not assuming that expansion through mergers and acquisitions is an easy fix,’ says AJ Bell investment director Russ Mould. Even more so now we know that this process has been ‘more complex and challenging than expected’.

SLUGGISH SALES GROWTH

In the UK, Domino’s sold a record 535,000 pizzas - around 12 every second - on the Friday before Christmas, partially driven by its popular cheeseburger pizza.

But while its core UK and Republic of Ireland (RoI) posted final quarter sales growth of 6.2% in 2018, UK like-for-likes came in at just 4.5% in the 13 weeks to 30 December.

This time last year the company was reporting 6.1% equivalent uk like-for-likes.

Regular readers of Shares will not be surprised by the slower growth as we have covered the company’s troubles extensively, including concerns that new store openings are cannibalising existing ones.

Back in October, we questioned whether a share price rally was justified following a £25m share price buyback to boost earnings and its struggling share price.

Source: Numis

RISK OF EXPANSION SLOWDOWN

Management at Domino’s may also be wary of the cannibalisation risk in the UK as the company reduced the amount of new store openings last year.

Liberum analyst Wayne Brown is worried about the lack of visibility for store openings as the pipeline is ‘similar to 2018’ - yet Domino’s missed its initial target by 30%.

‘UK openings are at risk of being cut materially as the transfer of profits from franchisees to plc has gone too far in our view,’ comments Brown.