Unseasonably warm winter weather this year has impacted significantly on agricultural commodity production but its effects on energy prices are set to be even more far-reaching according to recent research from Goldman Sachs.

It won't have escaped the attention of most readers that here in the UK and indeed across Europe and North America, we are basking in temperatures better suited to a mellow September than dreary December. The usual suspects such as global warming as result of greenhouse gas build-up are being blamed but other factors are also at play.

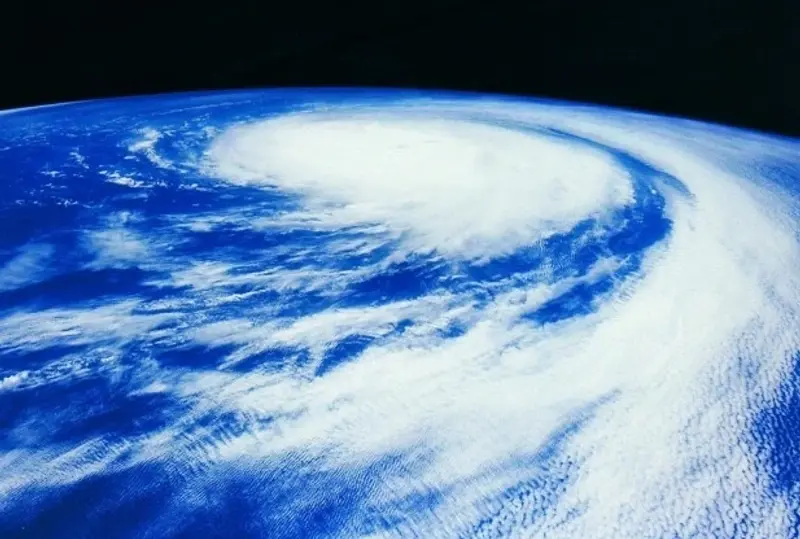

One of these is El Niño, a weather event which impacts at irregular intervals of two to seven years, is characterised by prolonged warming in the Pacific Ocean sea surface temperatures and can cause significant global changes to both temperature and rainfall. Its effects can last anything from nine months to two years and the last El Niño episode in the Northern Hemisphere brought about the big freeze of Winter 2010.

So between escalating geopolitical tensions in the Middle East, a glut in oil production sending the price per barrel ever lower and a rebalancing Chinese economy that no longer has the same voracious appetite for commodities, it's fair to say that there are few reasons to be cheerful when looking at global macroeconomic forecasts for the year ahead.

The main takeaway from the Goldman note seems to be that the impact an El Niño has on commodities is difficult to gauge on account of the fact that each occurrence has subtle but important variations. Based on previous events however there is some evidence of supply-side negative effects on cocoa, wheat, palm oil and upside in soybean supply.

Inventories both in agricultural and other commodities have been building since mid-2014 as a result of significant oversupply and Goldman argues that 'negative demand shocks (or positive supply shocks) are now much more likely to have outsized negative price effects - particularly for commodities where storage is limited such as energy.'

Goldman warns that the effects of warm EU and US weather, strong China diesel exports on weak demand and resilient refining margins lead us to expect that EU distillate markets will reach 99% of storage capacity in January. This localized pressure could then easily spread into crude oil markets should refinery runs need to decline to prevent further increases in distillate stocks.'