Global electrical goods distributor Electrocomponents (ECM) delivers yet another strong trading update for the second quarter to the end of June with like-for-like group sales up 10%, confirming the first quarter’s trend of double-digit growth.

The stock advances 3.2% to 741.2p on the news.

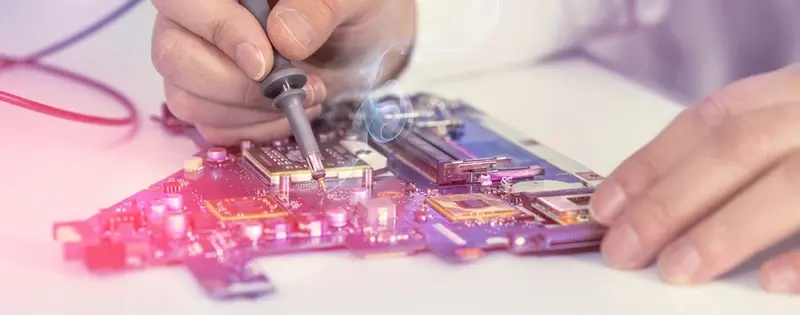

Electrocomponents supplies manufacturers worldwide with everything from electronic parts to tools and safety equipment, sourced from its own supplier base of 2,500 companies, and ships over 50,000 items per day to its customers.

Growth in the second quarter was driven mostly by the Northern and Central European divisions which together account for just over 40% of sales.

Within the European region the biggest market by sales is the UK, where the company is benefiting from market share gains and a strong manufacturing export sector thanks to a weak pound.

As well as selling third-party products, the company recently launched its own-brand range under the RS Pro banner. This strategy has been very successful with like-for-like sales of RS Pro up 12% in the second quarter. Margins on own-brand products tend to be higher than on branded goods.

ACQUISITION PROVIDES A WELCOME BOOST

Another highlight of the trading update is the performance of IESA which was acquired earlier this year. IESA is one of the UK’s leading providers of software to help customers manage sourcing, processing and management of their stock.

IESA is delivering ‘strong double-digit revenue growth’ as expected and new business performance is described as ‘encouraging’.

Electrocomponents management expects first-half pre-tax profit to be in the region of £100 compared with £79m a year ago but it is staying conservative with its full-year outlook to avoid raising expectations.

Growth in the quarter from July to September last year was particularly strong with like-for-like group sales up 14%, which sets the bar fairly high for this year. In addition, the company continues to invest in its RS Pro range and in its Asian business so not all the gains from sales will flow through to profits.

We like Electrocomponents and would expect analysts to continue nudging up their forecasts on the back of today’s update. The shares aren’t necessarily all that expensive on a current-year rating of 21 times but it’s worth noting that earnings aren’t forecast to grow until next year so despite the impressive sales growth there is an element of ‘jam tomorrow’ in the valuation.