Shares in FTSE 250 industrial and electronics supplier Electrocomponents (ECM) tumbled 13% to 610p, erasing all of October’s gains, after the firm delivered another disappointing trading update.

For the six months to the end of September, operating profits on a like-for-like basis were 2.1% lower at £104m while revenues grew by just 4.5% on a like-for-like basis to £978.7m.

In July the firm reported first quarter like-for-like sales up 4%, below market expectations of 5%, due to a slowdown in its electronics business, and lowered its gross margin target.

The situation clearly hasn’t improved in the second quarter as Electrocomponents saw growth in its industrial and own-brand RS PRO revenues ‘largely offset by ongoing softness in electronics’.

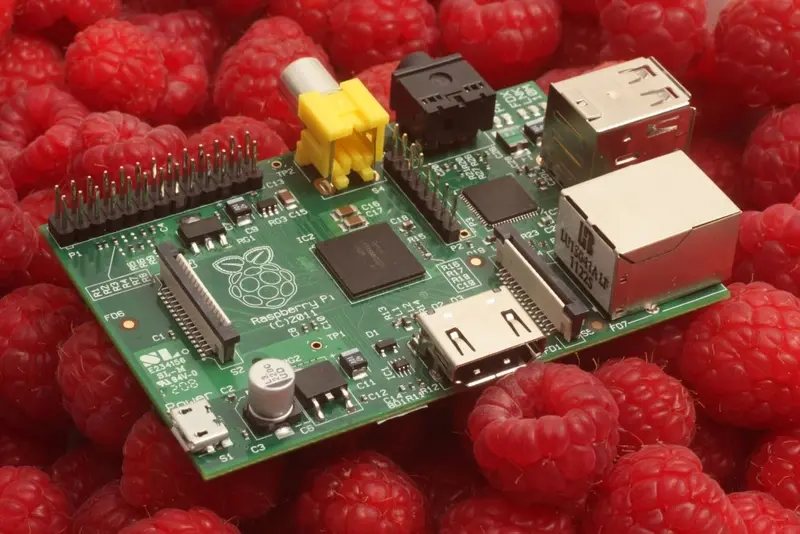

The gross margin (sales minus the cost of goods sold) was down by 0.7% to 43.7% due to a worse product mix - i.e. slower sales of higher-margin products and faster sales of lower-margin products - as well as the ‘repositioning’ of the electronics business and the launch of OKdo which sells and supports single-board computers like the Raspberry Pi.

While OKdo is growing fast, it is less profitable than the rest of the business so it has a negative impact on the overall group margin.

Adding to the negative tone was a £10.4m write-down on assets sold to British Steel, which went into liquidation in May without paying its suppliers.

On the bright side, revenue growth in the US and Canada accelerated sharply in the second quarter compared with the first quarter after a shake-up of the salesforce, and sales of the RS PRO product range continued to grow strongly from a low base.