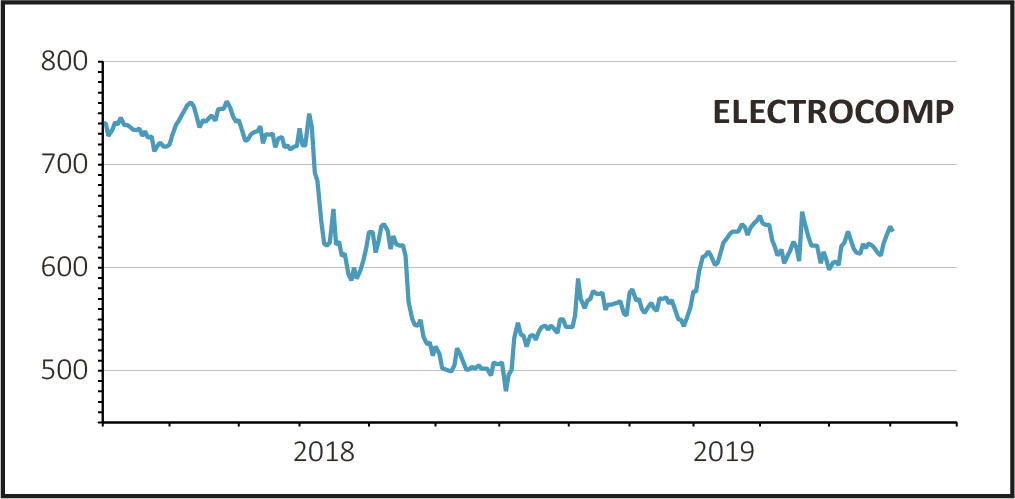

Electrical goods distributor Electrocomponents (ECM) has missed growth expectations with its latest quarterly trading period, sending the shares down 1.5% to 625p.

Like-for-like sales growth of 4% for the three months to 30 June was below the 5% expected by analysts.

Strong revenue growth in its Industrial arm, which distributes kit for maintenance and repair work, was more than offset by an expected slowdown in its Electronics arm.

The company also guided down expectations for gross margins as it plans to broaden its range of inventories in anticipation of future growth. A broadly flat margin is expected for the full year to March 2020.

READ MORE ABOUT ELECTROCOMPONENTS HERE

The company said its primary focus is on driving market share gains across all regions of the world, but this should be seen in the context of a ‘more uncertain’ external environment.

The Americas region saw like-for-like growth fall from 6% last quarter to zero, while Asia Pacific saw growth fall from 3% to 1%. Emerging markets held a strong 9% growth rate. Southern Europe dropped from 7% to 5%, and Central Europe fell from 13% to 3%.

The main reason for the lower growth trend appears to be cyclical, with weak industrial demand seen in the Americas and generally ‘softer’ conditions. Broker Shore Capital highlights the recent weak UK and European purchasing managers survey data which suggest weaker demand to come.

Offsetting these pressures are the company’s efforts to focus on tightly managing operating costs and investing to drive longer-term growth.