Specialist emerging-market debt investor Ashmore (ASHM) has knocked the ball out of the park again with full year results which show a 24% increase in assets under management (AUM) thanks mostly to inflows of new money.

At the end of June, AUM totalled $91.8bn compared with $73.9bn a year earlier. The bulk of the uplift, $10.7bn, came from net inflows of cash, while $6.7bn of the increase came from better performance across its funds.

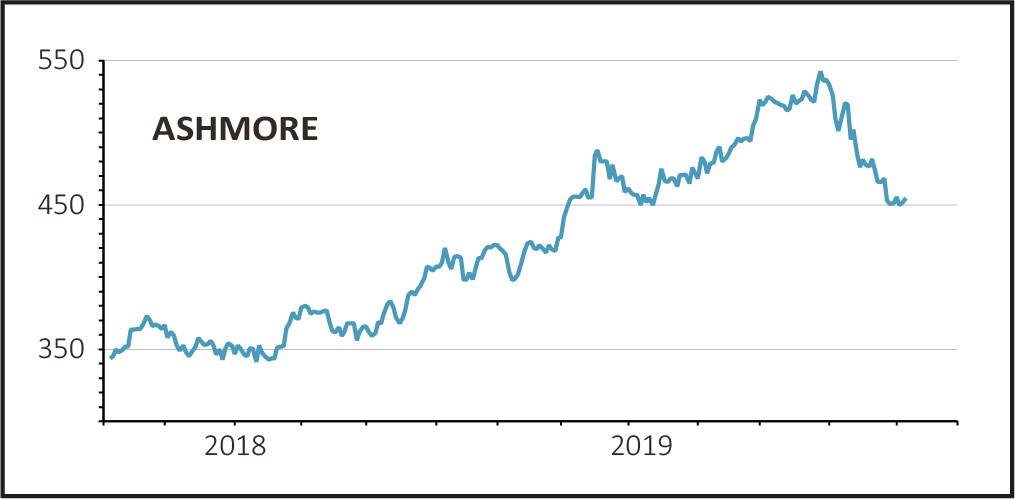

The shares barely responded to the news, adding 1.2% to 460p despite being sold off heavily in the last three months.

Ashmore says it saw strong client demand for its mutual funds in the US, where it has made a big marketing push in recent years, as well as in Europe.

It highlights short-duration, blended debt and local-currency bond strategies as particularly popular with new investors.

READ MORE ABOUT ASHMORE HERE

Ashmore’s client base is mainly institutional with a strong presence among central banks, sovereign wealth funds, governments and long-term pension plans.

These customers tend to be very ‘sticky’ which is good news for fees. In contrast retail investors, who are less ‘sticky’ and often chop and change their holdings, only make up around 15% of total assets.

Thanks to the surge in new money, net management fees jumped 17% to £294m while favourable exchange rates in emerging markets added £11.3m to revenues and performance fees added another £2.3m.

Ashmore’s performance record also stands out, with 90% of its assets beating their relevant benchmarks over one year and 97% beating their benchmarks over three years and five years.

As chief executive Mark Coombs highlights, elections in major emerging market countries like Brazil, India, Indonesia and South Africa produced outcomes which were market-friendly and supported hopes of more reforms.

That in turn helped emerging market stocks to gain between 1% and 5% overall while bonds gained between 9% and 12% in the last year, handsomely beating returns in developed markets.

Coombs sees ‘substantial growth opportunities’ for Ashmore due to the inefficient nature of emerging markets, the ‘frequent misunderstanding of the relationship between fundamentals and market prices, and outdated notions of the drivers of growth’.

He also flags the persistent underweight allocations by institutions and retail investors to emerging markets which means there is scope to increase assets further with the right marketing.