North Sea oil producer Antrim Energy (AEY:AIM) gushed up 45.7% to 8.38p after inking a deal with AIM-quoted peer Enegi Oil (ENEG:AIM) to develop its Fyne discovery.

The stock collapsed in March when it scrapped development planning for Fyne following a 'significant escalation' of expected costs and today's share price rise reflects a reappraisal by the market after it had essentially written off the field's value.

Through the non-binding agreement with Enegi, which managed a more modest advance of 1.3% to 7.22p in response, and joint venture partner Advanced Buoy Technology (ABT), unmanned production buoys will be used to produce from the field with an expected reduction in both development and operational costs.

Once the new field development plan (FDP) has been completed and approved by the Department of Energy and Climate Change (DECC) Enegi and ABT will together earn a 50% interest in the field.

DECC has indicated the FDP will need to be submitted by the end of January next year and first production must be achieved by November 2016. The parties have also declared an Area of Mutual Interest adjacent to Fyne where there are additional discoveries that could be tied back to the main development.

The Antrim deal is the first demonstration of Enegi's new strategy of using its buoy technology to leverage positions in marginal North Sea oil fields, an approach we examined in more detail last month.

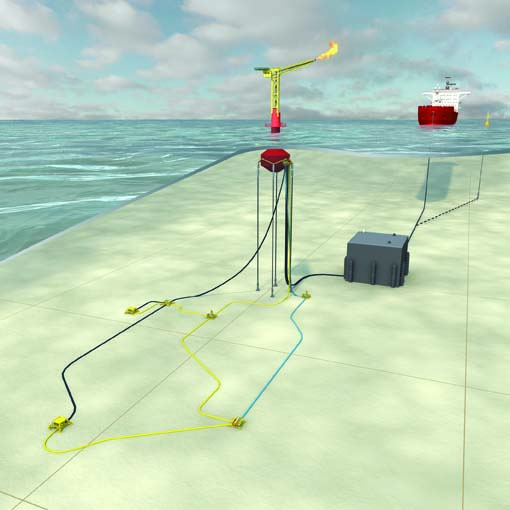

ABT?s system involves a buoy which sits just below the surface of the water housing production and processing equipment. The oil produced is then stored in a seabed storage facility before being collected by a tanker (see above).

Having assessed the scale of the opportunity in the North Sea, Enegi says there are 88 fields with less than 15 million barrels of oil equivalent of reserves (mmboe) which it believes no conventional offshore unit can develop economically. Fyne fits squarely into this category - the five wells drilled on the field to date have demonstrated 9 million barrels of oil reserves.

The key question for Enegi is funding. It claims to be confident that project finance can be secured for the production buoy and says it is already working with advisers to develop lines of credit which will be secured on the reserves and the equipment itself. However it will need cash to fund its share of the FDP costs before any reserves can be booked.