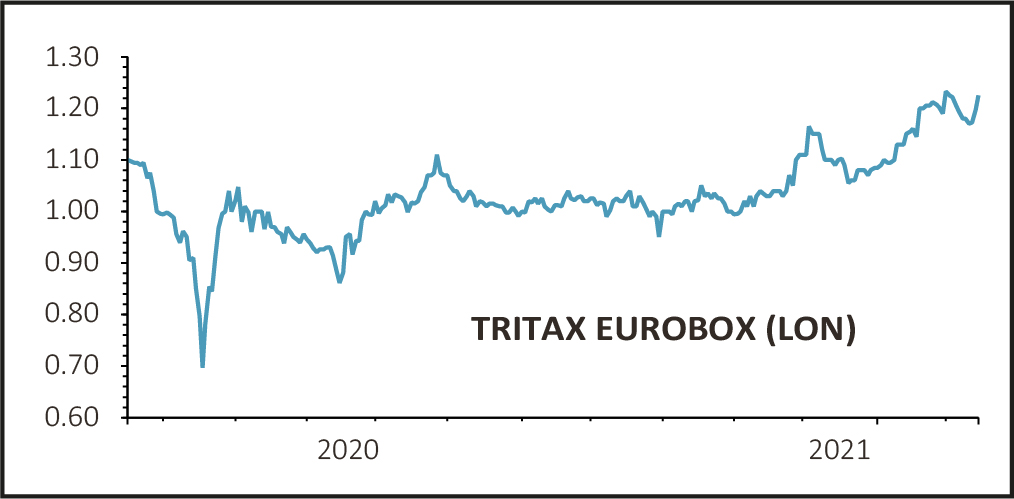

Shares in retail warehouse investment fund Tritax EuroBox (BOXE) added 2% to €1.23, pushing towards a new high, after the firm reported a significant gain on the sale of one of its Polish assets.

The sale of the site in Lodz, to British company Savills Investment Management, is for €65.5 million or a yield of 4.95% compared with a purchase price of €55 million in April 2019 and a starting yield of 5.8%.

The sale price is also 15 % above the most recent valuation of the site at the end of last September, and has delivered a geared internal rate of return (IRR) o 16.5% against the firm’s long-term target of 9%.

The site is currently partly let to Castorama, the French subsidiary of UK DIY retailer Kingfisher (KGF), for roughly another six and a half years, while another 101,000 square metres is available to let.

Nick Preston, the fund manager, said: ‘This profitable sale of one of our earlier asset purchases, 15% ahead of the latest book value, has delivered strong returns to our investors and is in line with our refined strategy of taking full advantage of these trends and crystalising profit, allowing us to redeploy capital into higher returning investment opportunities.’

The fund owns another site in Lodz, which it acquired in February last year for €52 million, and intends to invest a further €15 million to develop an adjacent plot for retail warehousing.

Analysts at research firm Liberum commented: ‘The sale is further evidence of the strength of investment demand for high quality logistics assets and will provide positive transactional evidence for upcoming portfolio valuations.

‘EuroBox trades at a considerable discount to European logistics peers and we expect a strong re-rating in the shares over 2021’, added the analysts.