Electronic chips distributor Premier Farnell (PFL) slumped close to its lowest price-to-earnings ratio in 40 years today after it announced plans to sell off one of its best performing businesses and cut its dividend in half.

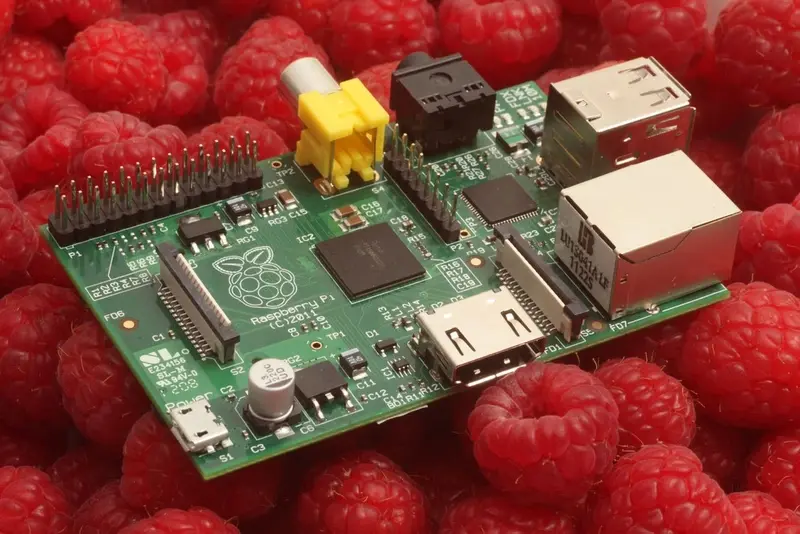

Raspberry Pi computer manufacturer Premier now looks to be admitting defeat on its strategy to grow out of what has become a stretched balance sheet position after years of declining margins.

‘The review announced in July is progressing rapidly,’ says chairman Val Gooding.

‘One of the key early decisions is to dispose of Akron Brass which, although an excellent business, does not fit strategically within the portfolio given the group’s refocus on its core distribution activities.’

Akron Brass has operating margins of 18%, more than double the group average.

A sale of the unit had been mooted previously by analysts because it focuses on industrial products, notably fire fighting equipment, rather than the electronics semiconductors Premier sells across the rest of the world.

Shares in the stock fell 13.6% to 115p.