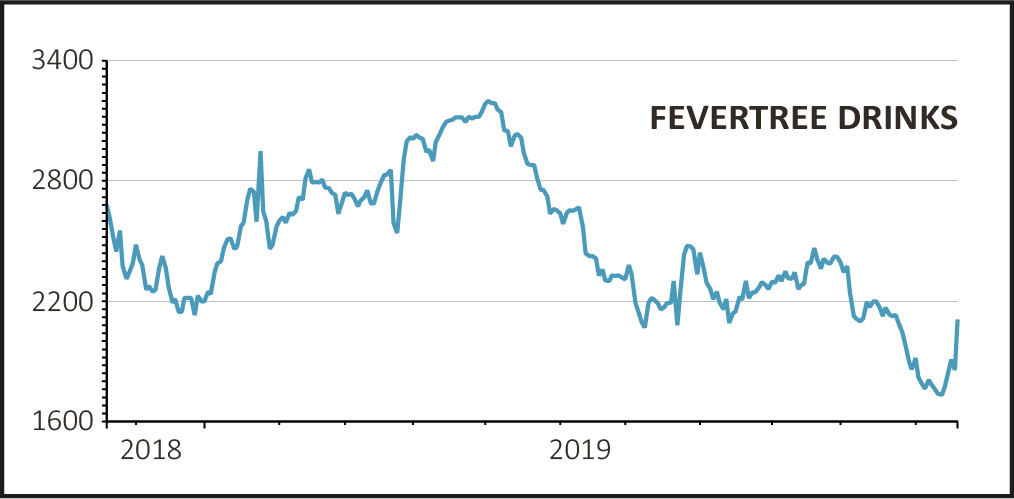

Confounding expectations, shares in AIM-listed carbonated-drinks seller Fevertree (FEVR:AIM) fizzed 11% higher to £20.70 after the firm broke with tradition and published a trading update trimming its sales guidance for the current year.

Due to weaker than expected UK off-trade sales - in supermarkets and convenience stores - caused by a slowdown in consumer spending, and a tough comparison with last summer, group revenues for the full year are seen in the region of £266 to £268m.

Although this still represents growth of 12% to 13%, and operating margins are seen unchanged, in absolute terms it means sales will be around £10m short of previous forecasts.

UK ON-TRADE AND EUROPE STEADY

Despite fears of competition from new entrants and ‘craft’ producers, smaller premium brands only account for around 5% of the UK off-trade market. Fevertree itself is still the market leader with a 38% share, while the rest is split between the former market leader Schweppes and supermarket own-brand products.

Fevertree’s on-trade sales through bars and restaurants, which make up roughly half of UK revenues, ‘continued to perform well’ in the second half thanks to new account wins and growing demand for mixers other than its iconic tonics. Among its new products are spiced-orange ginger ale, Madagascan cola and Sicilian lemonade.

Moreover, sales in Europe accelerated in the second half taking revenue growth for the full year to 19% and establishing the brand as the market leader in Belgium and Denmark.

US ABOVE EXPECTATIONS

The big swing factor for Fevertree is success in the US market, where it has partnered with one of the country’s biggest distributors.

Thanks to gains in the on-trade and off-trade, and continued strong growth in the premium mixer category, it has recently signed a US bottling partner to start production on the West Coast next year.

As a result, revenues in the US are now seen growing by around 34% in the year to December, ahead of the company’s previous expectations.

The US market for premium mixers is estimated to be more than 10 times the size of the UK market, so cracking 'the States' is key to the performance of the share price.