Publisher Pearson (PSON) gains 2.9% to 662.4p as it announces the retirement of chief executive officer (CEO) John Fallon and the sale of its interest in Penguin Random House.

The company has agreed to sell its remaining 25% stake in book publisher Penguin Random House to partner Bertelsmann for around $675m (£530m).

Proceeds would be used to fund a £350m share buyback in early 2020, with the rest used for general corporate purposes.

Pearson said the deal was in line with its simplification strategy and valued the Penguin Random House venture at an enterprise value of $3.67bn.

That compared to a $3.55bn enterprise valuation in 2017 when Pearson sold a 22% stake in the venture.

The sale is subject to regulatory consent and expected to close in the first half of 2020.

'This enables Pearson now to be completely focused on building the world's leading digital learning company, linking education to employability and skills, and reaching more learners around the world to support them through a lifetime of learning,’ says current chief executive John Fallon.

Fallon will retire in 2020 after a successor has been appointed.

STRUCTURAL PROBLEMS

AJ Bell investment director Russ Mould says: ‘The one-time publisher of the Financial Times has struggled in recent years. Its central problem being that students and educational institutions have moved away from buying expensive hard copy academic textbooks.

‘The group is inching towards a more digital future but, over his near seven-year tenure, Fallon has not been able to drive this change fast enough to prevent a series of profit warnings.’

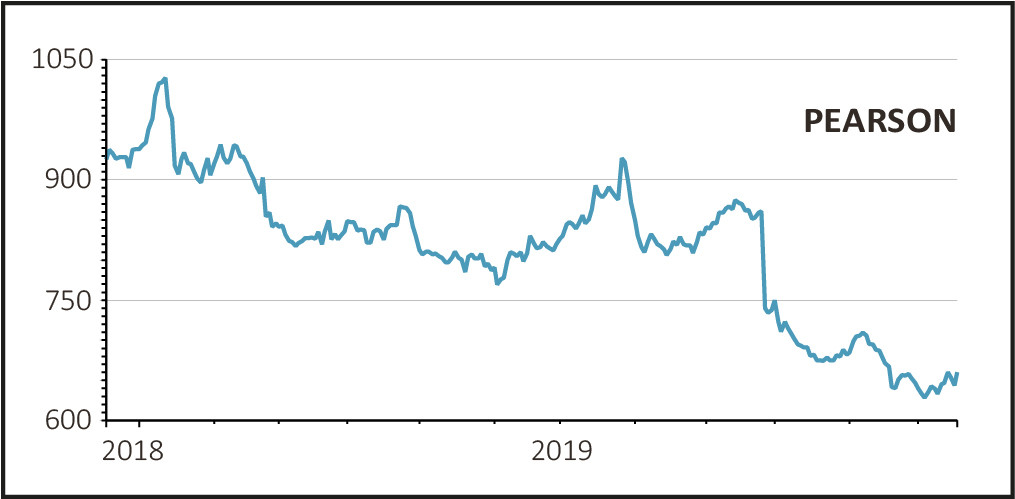

Although the shares enjoyed a strong recovery in 2018, that move has run out of steam this year and overall the stock is down by more than 40% since Fallon took the helm at the beginning of 2013.

Mould adds: ‘It is probably no surprise that the market isn’t shedding too many tears over Fallon’s impending retirement and news of a capital return from the proceeds of the Penguin Random House sale should please investors.

‘Given the structural problems facing the firm, his successor faces a tricky task. If they can turn Pearson into an educational publisher which is fit for the 21st century, Fallon’s work in moving the company in this direction may eventually be more warmly remembered.”

Shore Capital analyst Roddy Davidson says: ‘We believe that under Mr Fallon’s tenure, Pearson has completed much of the “heavy lifting” and investment in digital delivery and restructuring required to ensure that it is able to capitalise on an attractive long-term outlook for global education spend. That said, we welcome the introduction of a fresh perspective at CEO.’