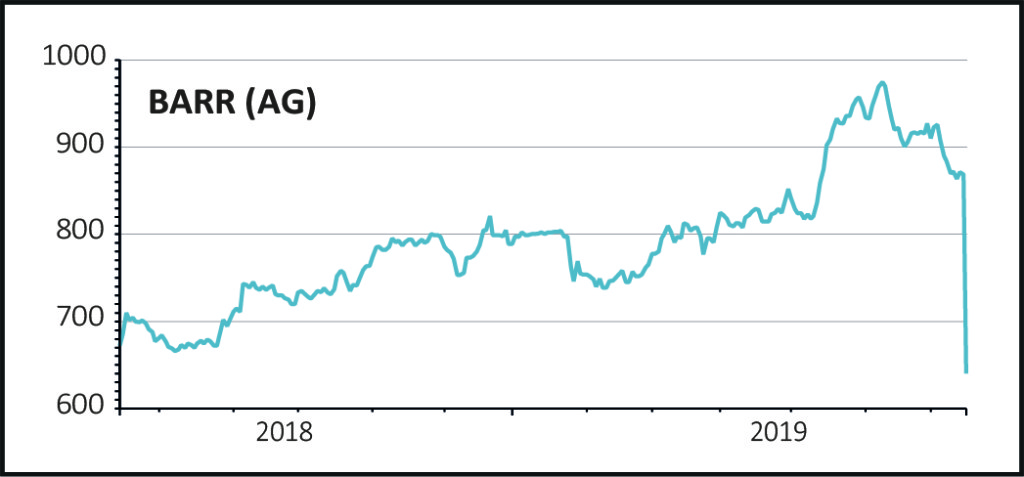

Shares in Irn-Bru-to-Rubicon soft drinks maker A.G. Barr (BAG) have crashed on Tuesday after dealing investors a savage full year profit warning.

The Glasgow-headquartered company saw its share price plunge 27% to 635p with the market seemingly caught on the hop by recent trading weakness. Yet the earnings alert is not so surprising, as Shares spelled out last month following a June weather washout.

A.G. Barr also blamed ‘some brand specific challenges’ for materially lowering guidance, which may give investors greater cause for concern.

DOWNPOURS DRIVE DOWNGRADES

A.G. Barr is a soft drinks manufacturer whose competitive advantage lies in a portfolio of differentiated, highly prized brands spearheaded by iconic Scottish fizzy drink Irn-Bru, launched in 1901 and made to a secret recipe.

But today’s pre-close trading update left a sour taste in investors’ mouths. A.G. Barr warned trading in the year to date has been below expectations, partially due to a strategy shift from a heavy focus on driving volume last year back to prioritising value now.

READ MORE ABOUT A.G. BARR HERE

This has been exacerbated by ‘some specific brand challenges, particularly in Rockstar energy and Rubicon juice drinks’, as well as disappointing spring and early summer weather with Scotland and the north of England afflicted by persistently heavy downpours.

Against a prior year comparative boosted by 2018’s summer heatwave, the soft drinks maker now expects sales for the 26 weeks to 27 July in the region of £123m, roughly a 10% year-on-year decline.

And reflecting the impact of operational gearing, full year profits are expected to drop ‘by up to 20%’. Investors should also brace themselves for results marred by exceptional costs as A.G. Barr seeks to restore trading momentum.

STILL A POTENT BREW

Russ Mould, investment director at AJ Bell, commented: ‘One can excuse the drinks company for not selling as many products in these conditions, however specific brand challenges with Rockstar and Rubicon are slightly concerning.

‘Management appear to have addressed the issues with a mixture of new product development and recipe improvements, however we won’t see the benefit of these actions until later this year or early 2020.

‘AG Barr has a good reputation of being able to deal with challenges such as the sugar tax where it had to reformulate its products. It is generally good at keeping up with changing consumer tastes, as illustrated by plans to launch an Irn-Bru energy drink this summer and the recent debut of its Funkin canned cocktails. It has also made an investment in alcohol-free adults drinks firm Elegantly Spirited. The ability to manage constant moving parts and have fairly resilient earnings shows that management are good at their job.’

Mould added: ‘Irn-Bru has a reputation of being the drink of choice for many people nursing a hangover and so investors’ headache may not be long-lasting if they stick with the drinks manufacturer.

‘One also has to think that the current sunny weather plays to AG Barr’s favour and so it may not be in a sticky patch for too long.’