Investors are lapping up interims from specialist engineer IMI (IMI) - up 3.2% to £14.54 - with the operating margin increasing from 16.6% to 16.8% year-on-year and the dividend hiked 8% to 12.8p.

Pre-tax profits hit £170.1 million from £168.3 million a year earlier - a strong contribution from its severe service business outweighing weakness in a fluid power unit constrained by exposure to a listless commercial automotive market.

As signalled alongside March's prelims second-half trading is still expected to be stronger than in the first six months of the year. Alongside the results the Birmingham-based company, which makes fluid control valves for nuclear power plants, liquefied natural gas (LNG) facilities and drink dispensers, announced the £41 million acquisition of Quebec-based Analytical Flow Products - expanding its product range and research and development capability.

In response to today's numbers, broker N+1 Singer reiterates its 'hold' recommendation with a price target of £13.76. Analyst Jon Lienard comments: 'The trends within the group are broadly as expected.' Investec has put its 'hold' rating under review, saying it expects to raise its price target as a result of a re-rating in the engineering sector.

Today's share price rise in response to in-line results can be seen in the context of the FTSE 100 constituent's medium-term strategy - outlined at a capital markets day last October - to increase its operating margin to 20% by 2017.

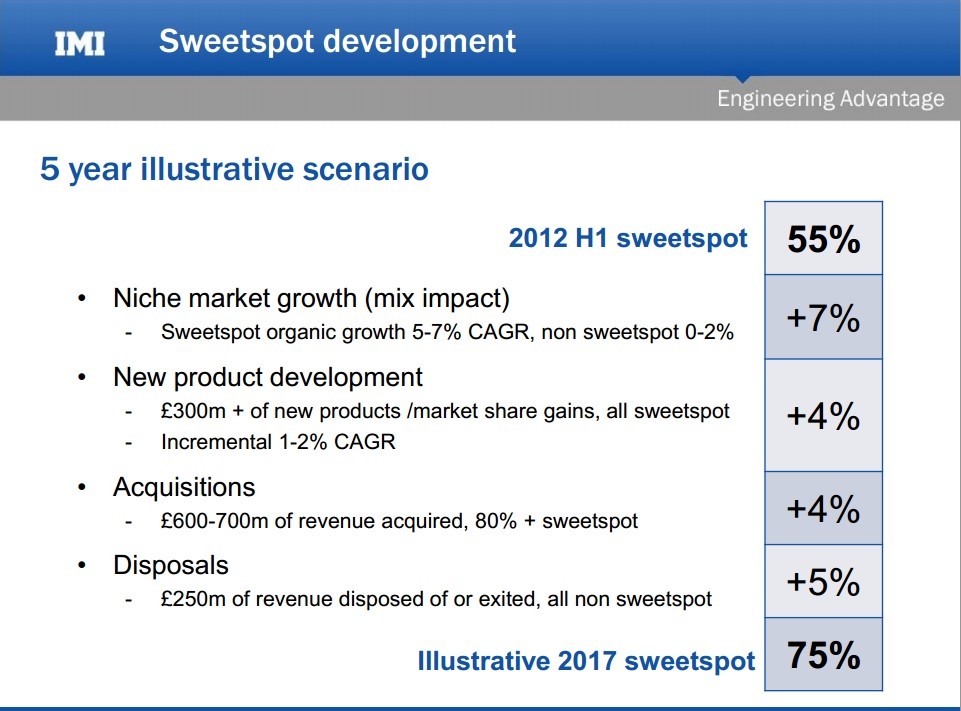

As the slide above shows, to achieve this it will concentrate a higher share of its activities in its ?sweetspot? - the areas where it is the clear market leader, can offer a product which is distinct from that of its rivals and achieve higher margins.

According to IMI, around 55% of its business currently falls into this category and it expects to increase this to 75% within five years. We looked at the investment case in more detail in May in a wider piece on the industrial engineering sector.