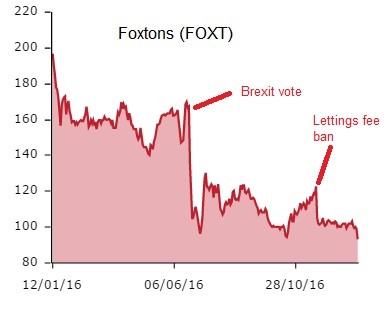

London-focused estate agent Foxtons (FOXT) falls 5.4% to 93.99p after saying earnings nearly halved in 2016 thanks to tax changes and the impact of the Brexit vote.

Its share price has now fallen by more than 50% over the past year.

CONSISTENT FAILURE

Floated in 2013 at 230p, the business has consistently failed to match expectations as the heat comes out of the London property market.

The latest update offers further evidence of a slowdown in the Capital's residential market.

Revenue in the final quarter of 2016 is down 25% to £26m and full year earnings before interest, tax, depreciation and amortisation (EBITDA) is off 46% at £25m, lower than the £27.4m pencilled in by analysts.

The lettings market is proving more resilient with revenue flat year-on-year at £13m but there is little sign an overall recovery can be achieved in 2017, particularly with lettings facing a potential hit from a ban on fees announced in November 2016.

Chief executive Nick Budden says 2017 volumes will likely be below 2016 levels and the best he can offer by way of cheer is a reference to a debt-free balance sheet and balanced business model.

Peer Countrywide (CWD), which has a UK-wide operation, falls 5.6% to 170p in sympathy.