Hopes of progress in trade talks between the US and China, and that a Brexit deal may still be pulled from the fire, have sent the pound soaring against the dollar in the last two days. In turn that has sent the domestically-focused FTSE 250 index sharply higher.

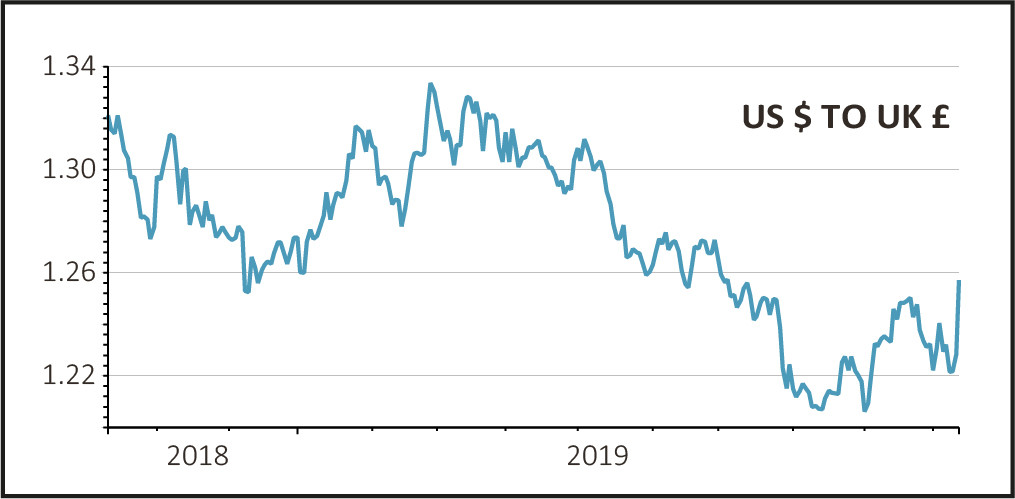

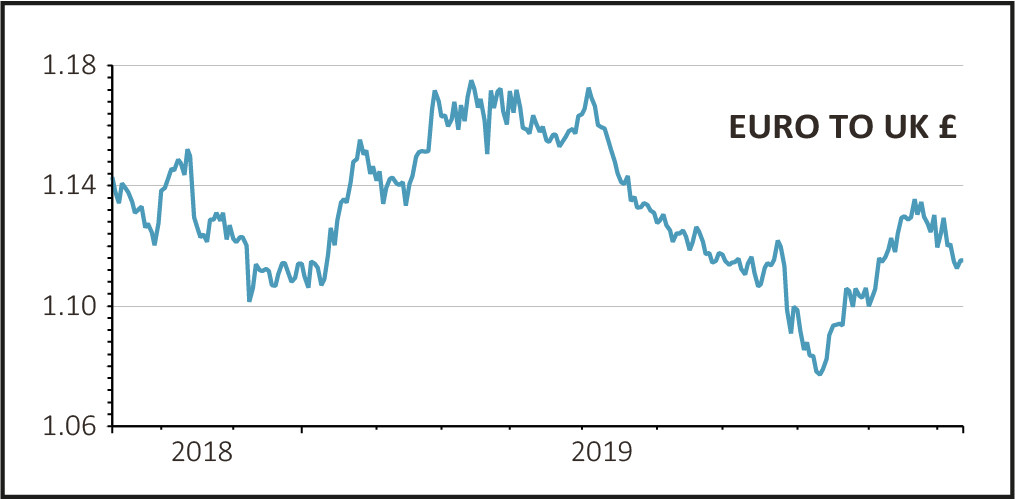

The pound has leapt by 3% against the dollar in two days to a three-month high of $1.257 although gains against the euro are more modest suggesting that the chances of a Brexit deal are still some way off.

The FTSE 250 index, which is largely made up of UK-facing companies, was up 2.6% to 19,729 points by lunchtime trading on Friday 11 October and was on track for one of its biggest one-day gains since the Brexit referendum.

After falling sharply following the vote three years ago, the index registered a sharp rebound adding 3.6% in a single day on 28 June 2016.

Major gainers on the FTSE 250 today included housebuilders, retailers and banks, all of which have been underperforming the broader indices on fears that the UK might leave the EU at the end of the month without a deal in place.

By contrast, the major losers were mainly overseas-focused investment trusts with large US dollar exposure.

Meanwhile the FTSE 100, which is predominantly made up of companies which earn their profits overseas such as exporters, was clinging to its opening gains, up just 0.1% to 7,196 points.

Major gainers among the FTSE 100 stocks were banks, retailers and housebuilders while the big losers were healthcare, household goods and food, beverage and tobacco companies.