Mining companies were among the biggest fallers in the FTSE 350 today as markets worry about the impact from the coronavirus outbreak in China.

The country’s government has extended the national holiday by three days to help contain the virus, with Chinese companies advising staff to work from home or take longer holidays.

Retail, leisure and hospitality are the sectors set to take the biggest hit with shops, bars and restaurants closed in the worst affected areas, but investors are starting to worry about the knock-on economic impact in commodity-hungry China.

CHINA’S COMMODITIES IMPACT

The country is by far the biggest influence on global commodity markets, with its 1.4bn population and rapidly growing economy (by global standards) fuelling energy and base metal demand.

Nearly two thirds of all iron ore exports to go China, while the country accounts for almost 50% of the world’s copper demand and around 14% of global oil consumption.

According to ING, SGX iron ore prices have dropped more than 10% since the first case of the new strain of coronavirus was detected, reflecting growing uncertainty over steel demand with industrial activity set to be lower due to the extended holidays and continued restrictions on movement if the virus threat persists.

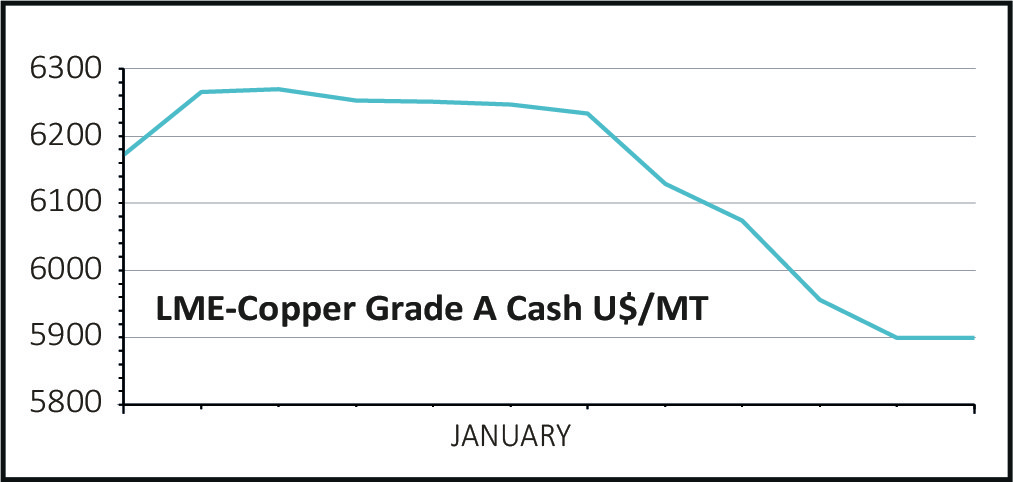

LME copper is down more than 8% since its peak earlier this month, with Brent crude oil down around 9% since the first case was confirmed.

SECTOR DRAGGED DOWN

Falling commodity prices would explain why most of the FTSE 100 and FTSE 250 miners are down today.

Shares in major iron ore producers have fallen sharply in mid-morning trading, with BHP (BHP) down 4.4% to £17, Rio Tinto (RIO) down 4.75% to £42.27, Anglo American (AAL) down 4.6% to £20.32 and Ferrexpo (FXPO) down 5.5% to 140p.

Pure play copper miners Antofagasta (ANTO) and KAZ Minerals (KAZ) have both fallen 4.3% to 838p and 456p respectively, while oil and gas giants Royal Dutch Shell (RDSB) and BP (BP.) are both down 2.1% to £21.52 and 475p respectively.

Share prices of miners typically fall by a larger amount than commodity prices, though major diversified miners BHP, Rio Tinto and Anglo American haven’t fallen by the same amount as iron ore or copper prices for example.

But it’s a different story for single commodity miners. Antofagasta’s share price is down 15% from a peak of 984p since the virus hit, while KAZ Minerals is down 20% from a peak of 570p and Ferrexpo down 11% from a peak of 157p.

SEEING BEYOND THE OUTBREAK

AJ Bell investment director Russ Mould said stock markets have been impacted by the uncertainty surrounding the outbreak, but past health crises show a quick bounce back once cases have peaked.

He said, ‘The difficulty for investors is that it is extremely difficult to predict what turn events might take in the coming days and weeks. Until there are signs the virus has been contained equities look set to be dogged by uncertainty.

‘Previous experience of global health crises does at least suggest there could be a fairly rapid recovery once the number of cases has peaked.

‘A sell-off in Japan overnight - with other major Asian markets closed for a holiday - has spread to Europe with the FTSE 100 handing back all of the gains it made on Friday and then some.

‘The heavy weighting of the index towards the resources sector has exacerbated the situation, given how these companies’ fortunes are closely tied to the commodity-hungry Chinese economy.’