UK stocks extended gains on Friday afternoon, with the FTSE closing 0.7% higher at 6,049 points, after figures showed the UK economy was continuing to recover from Covid-19 lockdowns.

Sentiment was also buoyed by the signing of a trade deal with Japan, the world’s third largest economy and the first such deal struck by the UK as an independent nation.

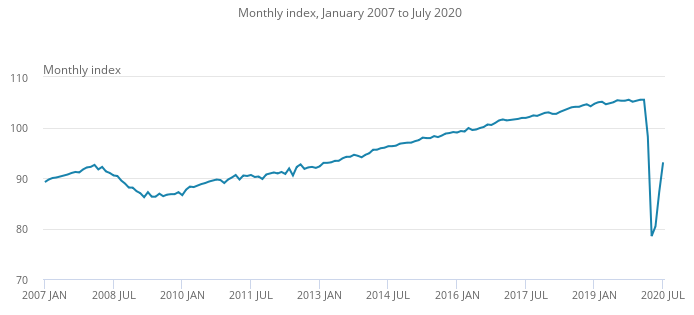

According to the Office for National Statistics, UK GDP grew by 6.6% in July compared with June with all sectors showing an improvement.

Source: Office for National Statistics

CORPORATE NEWS

On a thin day for company news, Rio Tinto (RIO) announced that chief executive Jean-Sebastien Jacques and Chris Salisbury, head of its iron ore unit, are set to leave the mining giant after pressure from investors following the destruction of ancient Aboriginal heritage sites in Australia earlier this year.

The news comes just a week after chairman Simon Thompson said Jacques had the board’s backing. Rio shares gained 4.6% to £50.

Specialist emerging markets fund manager Ashmore (ASHM) posted solid full-year results for the period to 30 June with net revenues up 5% driven by a 7% increase in net management fees.

Net inflows were flat over the year with positive flows into equity products in each quarter, although total assets under management (AUM) fell 9% to $83.6 billion due to negative performance of $8.1 billion caused by the Covid-related fall in markets in the second half. Shares dipped 3.7% to 377p.

Music royalty firm Hipgnosis Songs Fund (SONG) announced the acquisition of the music catalogue of songwriter and performer Chrissie Hynde,. The shares closed unchanged at 122p.

The news comes immediately on the heels of yesterday’s announcement of the acquisition of Big Deal Music, together with its catalogue of 4,400 songs, and the issue of another 17.6 million Hipgnosis shares.

Further down the market, property franchise firm Belvoir (BLV:AIM) revealed that founder and former chairman Mike Goddard would sell 2 million shares or 5.7% of the company’s capital at a price of not less than 150p in an accelerated book-build managed by broker finnCap (FCAP:AIM). Shares fell 6.5% to 152p.

FOR A LIST OF FTSE RISERS AND FALLERS SEE HERE