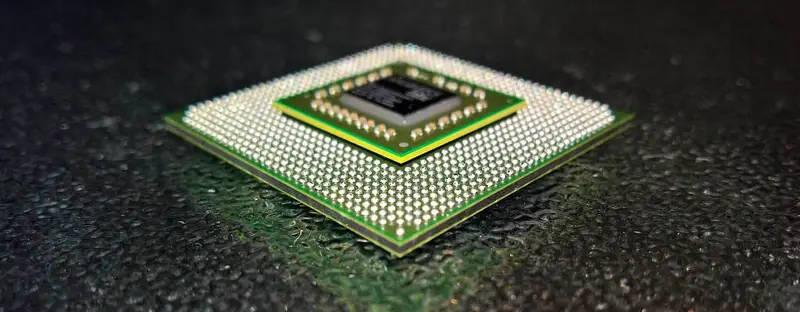

London’s FTSE 100 plunged deeply into the red by close on Tuesday, reversing significant earlier gains as concerns over a global chip shortage sparked a tech sell-off in the US.

The global shortage of semiconductors has put pressure on tech and carmaker stocks, which are leading the falls. The UK’s benchmark index fell back below 7,000 to close 0.67% lower to 6,923.

In the US the tech-heavy Nasdaq index is down over 2.6%, while the S&P 500 has fallen 1.2% and the Dow Jones has dipped 0.4%.

Traders are reportedly blaming a ‘micro flash crash’ for the drop in global stocks, with the pan-European STOXX 600 also tumbling with a 1.5% drop.

£60 MILLION BUYBACK FOR FRASERS

In company news, retailing group Frasers (FRAS), the old Sports Direct, rallied 5.2%% to 542p after it kicked off an up to £60 million share buyback.

Advertising company S4Capital (SFOR) firmed 2% to 570p having upgraded its annual guidance after its first-quarter gross profit jumped 71% as acquisitions boosted sales.

S4Capital, run by Sir Martin Sorrell, also announced that it had acquired Brazilian digital performance agency Raccoon, for an undisclosed sum.

Outdoor advertising group Ocean Outdoor (OOUT) reversed 0.9% to $8 as it booked a £184.3 million annual pre-tax loss after its revenue slumped 17% and it wrote down the value of its assets, citing the pandemic.

Subprime lender Provident Financial (PROV) fell 2.8% to 238p after it said it would announce the outcome of a review of its troubled consumer credit business next Monday.

Provident Financial said it had noted recent media coverage regarding the review, including the possibility of a managed run-off of its home credit and Satsuma businesses.

Healthcare investor Syncona (SYNC) climbed 3% to 244.5p on news that portfolio company Gyroscope Therapeutics had set a price range for a planned initial public offering in the US.

Syncona said that range would represent an increase in value of its current shareholding in Gyroscope of £52 million-to-£72 million, or 7.7p-to-10.7p per Syncona share.

Real estate investor Londonmetric Property (LMP) rose 0.2% to 225.8p as it secured £780 million of refinancing, including a £380 million private debt placement and two revolving credit facilities totalling £400 million.

Student accommodation developer Unite (UTG) added 0.8% to £11.73 as it extended a London-focused joint venture with GIC by 10 years to September 2032.

SMALL CAP WRAP

Cocktail bar group Nightcap (NGHT:AIM) sank 18.3% to 27.38p, having launched a £4 million share issue, at a yet-to-be-determined price, to help fund the acquisition of Adventure Bar, which would see it operate nine more properties.

The maximum acquisition cost for Adventure Bar was £2.5 million, including an initial £1 million and up to £1.5 million of deferred consideration, dependent on financial performance.

Flooring manufacturer Victoria (VCP:AIM) firmed 2% to £10.00 on news that it had acquired Dutch artificial grass and carpets group Edel for €49.4 million.