On 1 December mobile apps platform business Mobile Streams (MOS:AIM) launched a fund raising exercise, looking for £1.6m.

What it got, as the company confirms today, was £2.2m. That investors are willing to back the business at the 4p per share placing price is not terribly surprising given the massive 50% discount the new stock was offered at.

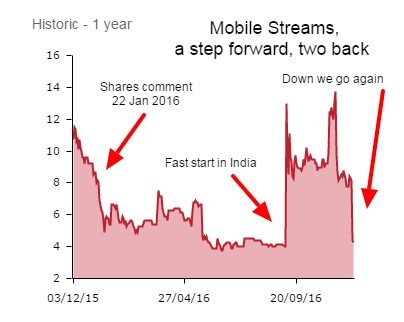

You can see what the cheap stock sale has done to the share price - not pretty - crashing 46% yesterday, down another 3% today to 4.25p.

We have discussed in the past the relative merits of the business, its struggles in Argentina, focus on new markets in Nigeria and India particularly, and its very limited success to date.

What was interesting about this particular cash call was the company's use of the PrimaryBid platform, which gives private investors relatively cheap access to share placings. In principle, that's great for the little guys. Retail investors are often excluded from company fund raisings because, most will tell you, of the high cost.

This particular exercise appears to flag the flaws in that argument, and perhaps PrimaryBid's platform will get a lot more use in future.

That said, I wouldn't hold your breath. So far it has been largely used by resources minnows, and for pretty paltry sums, last month's significant £26.9m fund raise for Sound Energy (SOU:AIM) aside.

PrimaryBid fund raises, last six months:

Mayan Energy £750,000

Ascent Resources £500,000

ECR Minerals £60,000

Diamondcorp £50,000

Scotgold £35,000

Terra Nostra Oil & Gas £25,000

It might be argued that the only companies to so far use the service are those to have gone cap in hand to the City and had the door slammed in their faces, which we presume was the case with Mobile Streams.

Whether a higher quality growth company would use the PrimaryBid funding platform remains to be seen.