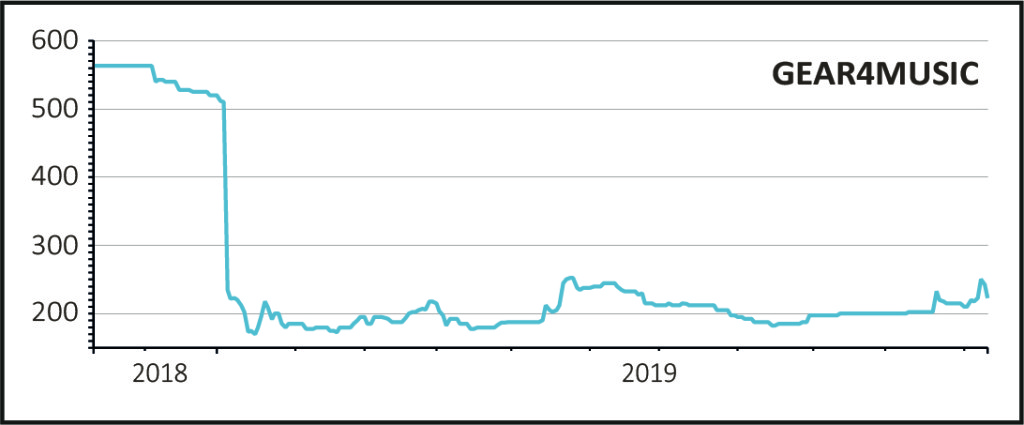

Shares in online musical retailer Gear4music Holdings (G4M) sounded a flat note today, retreating 8% to 222.5p as the company reported a strong recovery in first half gross profit but downgraded its revenue expectations for the full-year.

Revenues for the period ended 30 September were 16% ahead at £49.4m, driven by strong growth of 33% in international sales while the UK market contributed just 3.3% growth.

The operational and commercial changes made to the business over the last year resulted in higher gross margins of 25.2% (22.7%) and gross profits of £12.5m. Earnings before interest, tax, depreciation and amortisation (EBITDA) shot up to £2m.

Chief executive Andrew Wass commented, ‘as we approach the Christmas trading period, we will remain focused on improving profitability rather than driving growth in market share, particularly in the UK where the market remains highly competitive.’

RE-TUNING THE BUSINESS

The company has been focused on delivering margin improvements and building the systems to enable sustainable, profitable future growth. Today’s update goes a long way in demonstrating success in this regard, especially as there are more benefits to come from operational leverage.

Higher operational efficiencies mean that the company is able to achieve its expected EBITDA with lower revenue growth for the full-year. Broker N+1 Singer has lowered its revenue expectations by 11% to £122m for the year ended 31 March 2020 while leaving its EBITDA and earnings per share forecasts unchanged at £4.1m and 3.8p respectively.

Management has indicated that it plans to move back toward more ‘growth-focused projects’ next financial year. Given the higher margins, N+1 Singer estimates that each 2% in incremental sales growth will result in around 15% higher earnings.

PEAK SEASONAL TRADING KEY

How the company copes with peak trading over the next few weeks will be keenly watched by investors given last year’s Christmas trading issues.

G4M is the leading online player in the UK, but still has only around 7% market share, while in Europe its share is less than 2%. The growth opportunities are therefore significant if the company can execute well.

The key to securing profitable growth is related to the penetration of the company’s own-brand products, and the signs are positive as witnessed by the 43.4% growth in the first half compared with 7.5% for branded sales growth.

The company generates around 27% of revenues from its own brands despite them only representing around 6% of the outstanding items for sale.

The prospects for continuing growth remain good as shown by the 40% growth in active customers and increasing loyalty with 27% of them becoming repeat customers in the last 12 months.