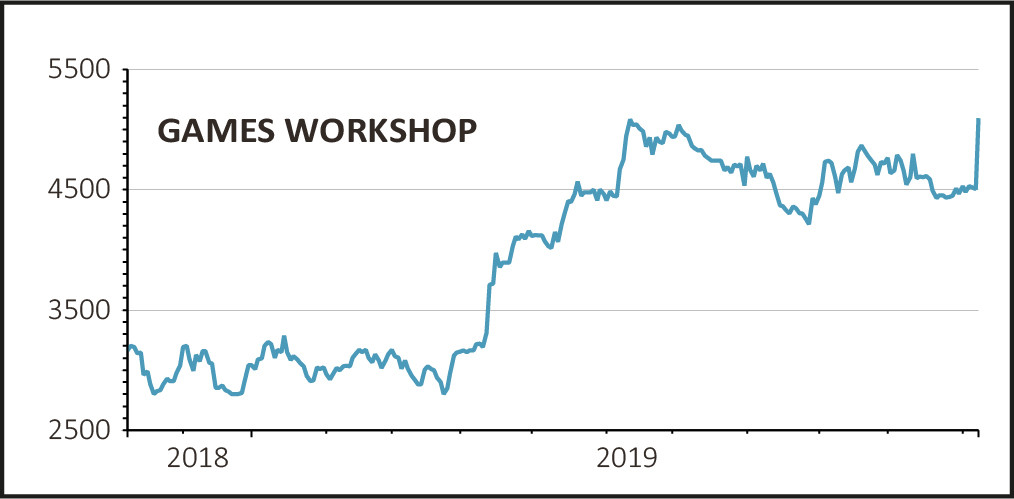

Fantasy miniatures and war games retailer Games Workshop (GAW) has clearly mastered the art of communication. In than than 100 words and by providing just two numbers it has excited investors enough to send the shares up 17% to £52.72.

Commenting on preliminary results for the six months to 1 December the company has guided for revenues to be higher than £140m and for pre-tax profits to be higher than £55m.

Last year revenues were £125m and pre-tax profit was £40.8m, so what the company is indicating is that revenues are likely to be £15m higher and virtually all of those extra revenues (£14.2m) are falling to the profit line.

This demonstrates the power of operating leverage whereby the company is able to grow revenues at virtually zero incremental cost.

UPGRADES TO COME

The consensus expectation is for full-year revenues to hit £271.4m and pre-tax profits to be £85.1m according to Reuters data, implying that the company is running well ahead at the half-year stage.

Not surprisingly, broker Peel Hunt has raised its earnings per share forecast by just over 9% for the current financial year to 2 June 2020 and by 10% for 2021, at 225.5p and 234.9p respectively.

The broker sees a step-change in royalty income and expects it to hit £10m in the first half, more than doubling from last year. This reflects the signing of new agreements as well as existing franchises, such as Warhammer II and Warhammer Vermintide.

‘While it isn’t entirely immune from any economic downturn and the negative effects that might have on consumer spending, there is a sense that Games Workshop is currently enjoying a sweet spot whereby it is offering products which appeal to its end-market and in an engaging way,’ says Russ Mould, investment director at AJ Bell.

‘The community spirit of its offering, particularly the way staff interacts with customers in-store, gives it an edge over mainstream retailers.’