Investors are today facing up the likely scale and length of any recovery at online musical instrument-seller Gear4music (G4M:AIM).

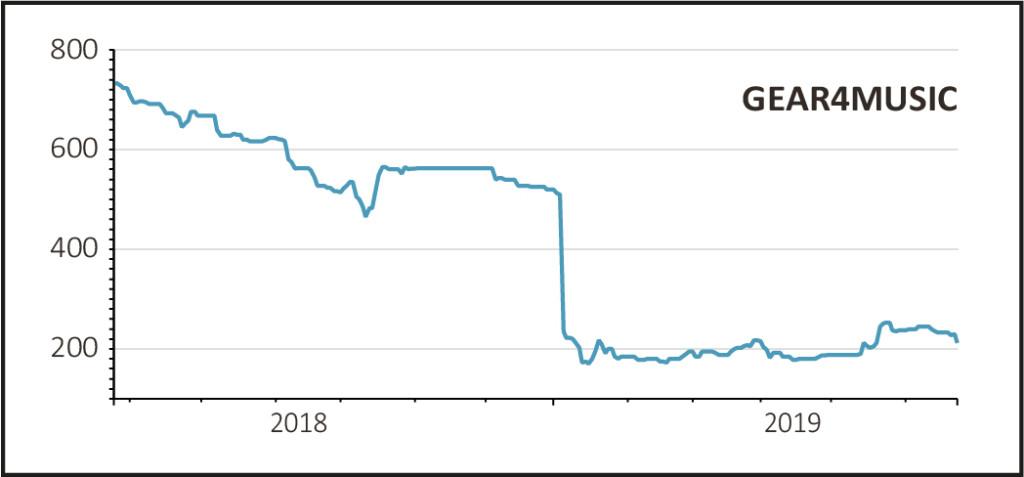

Shares in this once popular retail investor story have slumped nearly 8% to 212.5p after full year results to 31 March 2019 crystallised pre-tax losses of £609,000, a huge reverse on the £1.5m pre-tax profit of the year before.

That the red ink flowed last year despite a 48% increase in headline revenue to £118.2m clearly illustrates the extent of the margin pressures it has, and continues to face.

TOUGH MARKET

The online instrument market was impacted last July and August by a number of small retail operators struggling to stay afloat, and that led to aggressive discounting on stock, forcing Gear4music to reduce its own prices.

The biggest challenge has been in third party branded products where margins fell by 3.3% to 22.7%. Third party sales account for roughly 70% of revenue volume so this is a big problem, one that easily offsets more robust pricing and margins from its own-branded products, which actually improved slightly to 41.2%.

This had all been flagged in January's huge profit warning that smashed the share price, and followed up by what amounted to a second alert in April.

BRIGHT SPOTS

What will likely reassure investors to some extent is a 60% increase in website visitors and an improvement in the number of visitors actually buying something. This latter figure edged up from 3.2% to 3.4%.

International revenues increased 52% to £54.5m, also encouraging when management see overseas sales as a key part of the future growth strategy.

READ MORE ABOUT GEAR4MUSIC HERE

Plans to remedy margin pressures have already been put into action, and include a number of commercial and operational initiatives to address the previously reported issues.

FIXABLE PROBLEMS

Perhaps the most important is that Gear4music will concentrate on selling higher margin inventory in future, plus it will also resist major discounting and price matching ahead.

Chief executive Andrew Wass says that this, plus building an increasingly robust operational infrastructure, are ‘already yielding positive results.’

The company has also renegotiated its courier agreements and increased its options so that it can switch where necessary to avoid some of the issues it faced last Christmas. Courier costs peaked at 9.4% of sales in December 2018.

If the company can demonstrate that the operational difficulties are temporary and fixable investors may again start to believe that the company can build on UK and European market share which currently stands at circa 7%.