Embattled Southern Rail operator Go-Ahead (GOG) is flagging an improvement in revenue trends at Govia Thames Railway (GTR) as service levels stabilise despite ongoing industrial strikes.

Southern is run by Go-Ahead’s 65%-owned GTR unit and its partner Keolis which owns the remaining 35%.

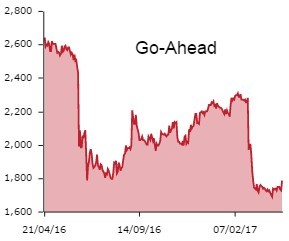

Investors are relieved and shares in the FTSE 250 transport group accelerate 3% to £17.83.

In February, management warned that strikes at Southern could hit full year profit by up to £15m.

Elsewhere in Go-Ahead’s rail division, London Midland continued to perform well with decent growth in revenue and passenger journeys.

This is reassuring for management as it waits for the Department of Transport to decide who will take over the contract when it ends in October 2017. It is currently competing against one other bidder.

Passenger volumes in its regional bus division are patchy but the company has ultimately delivered higher revenue as outperformance in some areas has offset declining volumes elsewhere.

Less positively, management is forced to implement a cost-efficiency programme to offset a revenue shortfall from Southeastern until its contract ends in December 2018.

Passenger journeys at Southeastern have declined by 0.5% in the year to 1 April, compared to 2.5% growth in the year to 26 March 2016.

Stockbroker Investec analyst Alex Paterson has upgraded his recommendation from ‘add’ to ‘buy’, highlighting that Go-Ahead is outperforming the UK market in both its bus and rail divisions.

He notes a further rally in the share price could be triggered by an end to Southern strikes and if Go-Ahead can be keep the Southeastern rail franchise.

Despite being relatively upbeat overall, Paterson is cautious on margins in the bus and rail divisions.