The latest update from the real estate sector is a reminder of how tough times are out there as rent collection from certain parts of Great Portland Estates (GPOR) portfolio remains well below 50%.

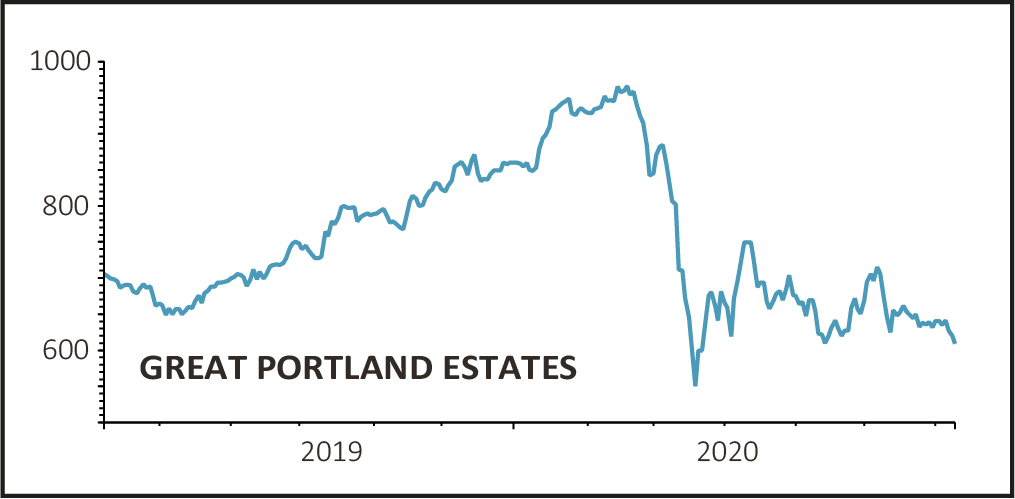

The London-focused landlord’s shares were flat at 609p as it said it had collected 69% of June rent as some of its occupiers’ ability to pay had been impacted by the Covid-19 pandemic.

The company also said that 82% of March rent had been collected.

The breakdown for June is interesting as it shows 74% of rent due has been collected from offices but just 28% from the retail, hospitality and leisure sectors.

‘Whilst the lockdown has started to ease and our office pre-letting momentum remains healthy, Covid-19 is disrupting the activities of many of our existing occupiers, which in some instances is impacting their ability to meet their rental payment,’ the company said.

‘For those occupiers who have been unable to pay their rent, we are continuing to implement measures to help support them through these unprecedented times,’ it added.

The company at least is in a strong financial position with £90 million of cash as well as a loan to value (LTV) of 15% and is continuing to progress its development projects.

Great Portland noted that the value of its properties could fall 68% before it would breach debt covenants which would be beyond the expectations of even the most pessimistic observers.

In a note from June Jefferies analysts Mike Prew and Andrew Gill commented: ‘GPOR is one of the most highly respected and successful REIT management teams with increasing bench strength and comes with the lowest gearing at a ‘sleep-easy’ 14% LTV after returning £616m of capital since 2017.’