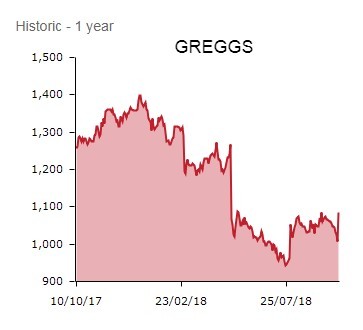

Investors have regained an appetite for Newcastle Upon Tyne-headquartered baker Greggs (GRG). What had been a stock largely unloved by investors, it is very much flavour of the day, the share price surging 7.2% to £10.78 on surprisingly robust third quarter trading.

Despite testing comparison figures and a headwind from ‘particularly hot weather’ Greggs traded well, and reassuringly, leaves full year expectations unchanged.

SALES ON THE RISE

Bouncing back from rather disappointing half year results served up in July, Greggs’ total sales ticked 7.3% higher over the 13 weeks to 29 September and like-for-like sales in company-managed shops (as opposed to franchised units) rose 3.2%.

This like-for-like performance is ahead of the 1.5% growth called for by broker Shore Capital, albeit representing a slowdown from last year’s demanding 5% growth comparative.

For the year to date, like-for-like sales at the bakery food-on-the-go retailer are up 2.1%. Shares views this as no mean feat when you consider 2018’s extreme British weather, bitingly cold and then baking hot, which has sapped high street footfall.

VALUE FOR VEGANS, AT GREGGS?

CEO Roger Whiteside says Greggs’ drinks range and new focaccia-style pizzas flew off the shelves over the baking summer months. And his charge ‘continued to see growth at breakfast time, helped by the expansion of our great value deals and our wide selection of freshly-ground Fairtrade coffees.’

Renowned for its value sausage rolls, coffees, doughnuts and value meal deals, Greggs has successfully increased the breadth of its product range and pivoted towards healthier products. Greggs was even recognised at PETA’s 2018 Vegan Food Awards, where it was awarded the ‘Best Vegan Sandwich’ gong for its Mexican Bean Wrap.

MARGIN PRESSURE

In the outlook statement, Greggs says ‘we were pleased with our trading performance during a period that included a long spell of hot weather, which made sales patterns more difficult to predict. This, and the resulting mix of sales led to a lower-than-normal trading margin in the first part of the quarter, offset by improved trading as we came into September.'

Gross margin came under some pressure during the hot weather because cold drinks and products such as pasta salads are bought-in, therefore earning lower margins, and also because there was more wastage on traditional products.

‘Greggs has issued a robust trading update for the 13 weeks to 29 September, a period of very hot weather which historically has proved to be a major trading headwind for the group,’ explains Shore Capital scribe Darren Shirley, reiterating his ‘hold’ rating and leaving his full year pre-tax profit forecast unchanged at £81.3m, so a flat profits haul year on year.

Paul Hickman, number cruncher at Edison Investment Research, believes ‘Greggs’ trading strength is remarkable in a period when a number of retailers have blamed scorching weather for declining footfall. But Greggs has significant differences from other retailers in terms of its customer cohort and shopping occasion.

‘Over the last five years Greggs has converted its shops to food-on-the-go formats, which increasingly serve working people rather than shoppers. The development of non-traditional locations such as garages and stations, now around 35% of the total estate, also helps to decouple trading from shopping occasions.

‘Part of the success too this summer was that Greggs has improved its offer at times like breakfast and later afternoon which are cooler than the middle of the day. Its breakfast package has been a great success.

‘Menu development meant that its shops were able to provide cold and light food and drink products that customers wanted during the heatwave.'