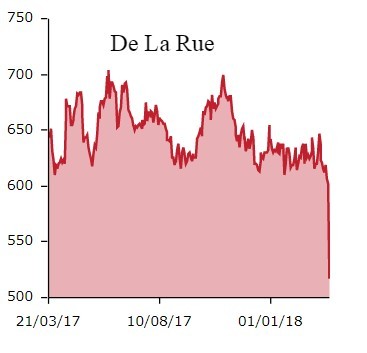

Bank note maker De La Rue (DLAR) sees its shares tumble by 12% to 530p after warning full year results will be at the ‘lower end of the current consensus range’.

However, given the narrow range of consensus forecasts for its underlying operating profits of between £71m and £73.4m, is this reaction too extreme?

According to Investec analyst Thomas Rands, it is. He states simply ‘overreaction, buying opportunity’, noting that the company compiled market forecasts only included three sets of estimates including his own.

Investec’s own £71m estimate was at the bottom end of the range and is not being changed. Rands also gives the company a ‘buy’ recommendation with his 700p price target implying 32.1% potential upside.

De La Rue has also announced the departure of its chief financial officer Jitesh Sodha. In fact the profit warning was buried in the same announcement, which may imply that De La Rue views this information as more important than its results guidance.

However, Sodha is remaining with the company until September to ensure ‘an orderly transition while a suitable successor is identified’. Sodha is leaving to pursue his career ‘outside of the company’ which doesn’t sound particularly ominous compounded by the fact that he’s staying until a replacement is found.

The Gateshead-based bank note and passport maker may have caught investors off guard given that the market announcement was unscheduled. The company also gave no reason why it expects its results to be at the bottom end of consensus forecasts.

Investec forecasts pre-tax profits of £59m for 2018, although this is expected to reduce to £53.6m for 2019 ‘reflecting the disposal of paper assets’.

Based on Rands’ forecasts, De La Rue is trading on 12.6 times forecast 2019 earnings of 41.9p with a dividend yield of 4.7%.

The company will update the market in the third week of April, when it will hopefully give more reasons for its lowered guidance. Losing over £70m of its market value due to a £2.4m operating profit miss seems extreme, even with the departure of a chief financial officer.