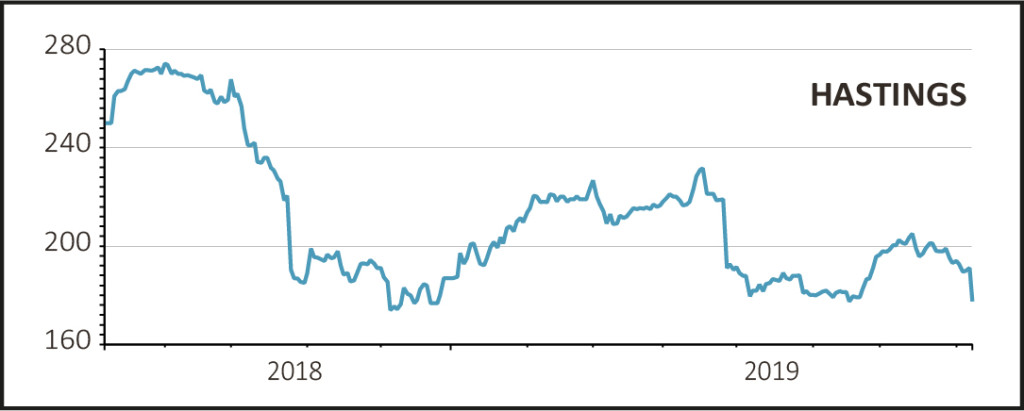

Shares in Sussex-based car insurer Hastings (HSTG) hit a new low for 2019, down 9.5% to 173p after it reported a 25% fall in first half operating profits.

While the number of live policies increased by 4% to 2.8m and its share of the UK car insurance market increased from 7.5% at the end of last year to 7.8% in June, gross written premiums were up just 3% thanks to a round of price rises.

Although it hiked prices, taking on less risk meant that Hastings made a lower margin in the first half of the year. At the same time claims inflation accelerated faster than premiums to between 6% and 7% so operating profits were squeezed from both sides.

Factoring in the change in the Ogden rate, operating profits were down even more than the headline rate of 25%.

READ MORE ABOUT HASTINGS HERE

Hastings prides itself on its investment in technology which it hopes will drive more customers to use its products. It claims that its mobile app is ‘amongst the highest rated insurance apps in the UK’ and that over half of claims are settled through digital channels, which keeps its costs down.

However the car insurance market is becoming increasingly costly as more vehicles are being stolen and the cost of repairing or replacing them is rising by more than companies can put up their premiums.

According to Home Office figures, car thefts hit an eight-year high in 2018 with over 100,000 vehicles stolen in England and Wales alone. A new theft claim was made every six minutes and insurance pay-outs were over £1m per day last year.

Part of the reason for the spike in thefts is ‘key-less’ entry systems which are popular not just on high-value cars such as BMWs and Range Rovers but also on Britain’s biggest-selling car, the Ford Fiesta.

A recent What Car? Test showed that many of these vehicles can be broken into and stolen in less than 30 seconds.

Meanwhile the cost of repairing cars is soaring as even simple items such as front and rear bumpers now come with sophisticated cameras and parking sensors. At the same time labour costs have risen due to a tight job market and the cost of imported parts has soared due to the weakness of the pound.

To make matters worse, the government’s decision to change the Ogden rate from minus 0.75% to minus 0.25%, rather than the original guidance provided by the Ministry of Justice of 0% to 1%, meant that Hastings had to put aside an extra £8.4m of pre-tax earnings to cover personal injury claims.

That pushed earnings after tax to £38.2m in the first half, a drop of 48% compared with last year, although the company insists it is confident it will meet its full year earnings expectations.

We warned last month that the lower Ogden rate would impact general insurers’ earnings and that investors should continue to avoid the sector for the most part.