Soft drinks star Nichols (NICL:AIM) has warned that the recent escalation of hostilities in Yemen will stifle profit growth this year.

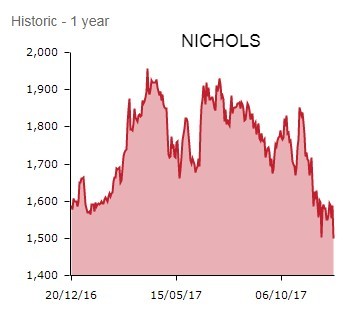

Clearly, these events are totally outside of management’s control yet the share price tumbled 7.5% to £14.70 in early trading on Tuesday.

This poses an interesting question for investors; has this created a longer-term investment opportunity in one of the AIM market’s most dependable consumer-facing companies?

PROFITS FALL FLAT

Nichols is behind the iconic and internationally popular Vimto brand. It also owns Feel Good, Levi Roots, Sunkist and Starslush.

In a 2017 trading update issued on Tuesday the company says the recent worsening of strife in Yemen ‘has resulted in the supply route to our Yemeni customer being blockaded. Therefore, at this time we are unable to send any further Vimto concentrate shipments that were planned for December 2017.’

Since the supply route to the Newton-le-willows-headquartered company’s customer in the Middle Eastern nation is being blockaded, key December Vimto shipments for Ramadan 2018 have been unable to be sent.

Consequently, Nichols’ management now expects adjusted pre-tax profit (PBT) for the 2017 calendar year will be flat. Headline sales will likely remain in an upwards trend driven by both the UK and wider international businesses.

But disappointingly, Nichols also warns 2018’s percentage profit growth is likely to be constrained to the low single digits, since the Yemen conflict ‘coupled with some reported slowing in the Saudi economy indicates that sales to the Middle East region in the year ahead are likely to be less than previously anticipated.’

BUYING OPPORTUNITY?

While this profit warning leaves a sour taste, seekers of corporate quality should view share price weakness as a buying opportunity in a highly profitable and cash generative company with a strong balance sheet and an enviable dividend growth track record.

Positives from the update include UK sales of Vimto, running 9% ahead year-on-year as at November 2017, significantly outperforming the 2.3% growth of the wider UK soft drinks market and partially helping Nichols to mitigate input cost inflation.

Furthermore, Nichols' African business is still on course to grow sales by more than 20% for 2017, despite tough prior year comparatives.

And notwithstanding the Yemen setback, Middle East sales are still expected to be ahead of 2016, which together with a reasonably confident outlook statement, suggests today’s share price sell-off is overdone.

ANALYSTS HAVE THEIR SAY

Broker N+1 Singer lowers its 2017 PBT estimate by 6% to £30.5m and its 2018 forecast by 11% to £31.1m.

‘Whilst it is disappointing to be downgrading, we strongly feel this should not overshadow Nichols’s fundamental attractions around geographical diversity, a progressive DPS policy and a strong balance sheet,’ writes analyst Sahill Shan, looking for a 32.2p dividend for 2017 to rise to 35.5p next year.