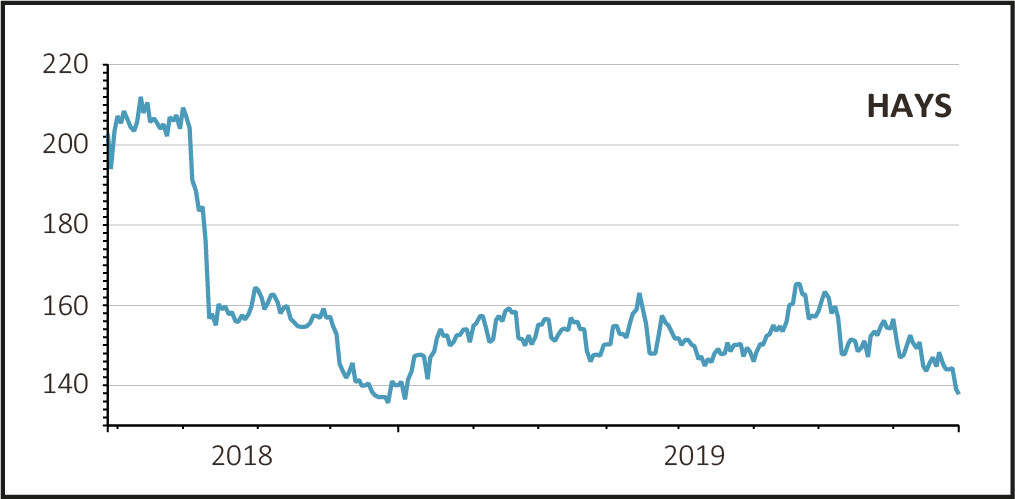

Shares in recruitment specialist Hays (HAS) recovered from their early losses to trade sideways at 139p at midday after the firm reported slowing growth in net fee income in the year to the end of June.

For the full year net fees grew by 6% on a like-for-like basis to £1.13bn but the rate of increase slowed sharply from around 10% in the first quarter to just 1% in the final quarter on a working-day adjusted basis.

Despite this the firm ended the year with a record level of net cash and plans to pay another special dividend, taking the total yield on the shares close to 7% or more than double the 3.1% yield on the FTSE 250 index.

Given slowing demand across parts of the global economy the firm delivered a solid performance, trimming costs and investment where appropriate to protect the bottom line. As a result operating profits for the year were up 4% on a like-for-like basis to £248.8m.

In addition, Hays ended the year with a record cash pile of almost £130m so as well as a core dividend of 3.97p per share (up 4% on last year) there is a third successive special dividend of 5.43p per share (up 9% on last year).

READ MORE ABOUT HAYS HERE

Net fees in Germany, the firm’s largest market accounting for 27% of fees and 36% of operating profits, hit an all-time record of almost £300m. IT, the largest specialism, saw fees grow by 9% while the second-largest specialism, Engineering, saw fees grow by 6%.

However there was a notable slowdown in Engineering between the first and second halves as companies moved from slowing their investment spend to controlling costs and then cutting costs.

The UK and Ireland, which make up 23% of net fees and 20% of operating income, saw a good first half but a subdued last quarter due to increased economic uncertainty over Brexit which inevitably affected companies’ willingness to hire.

Demand for IT staff, again the biggest specialism, remained strong with the public sector in particular keen to hire while Education remained tough and Construction saw a slowdown.

By region the South West & Wales stood out with a 14% increase in net fees while growth in London slowed to just 2% and fees in Scotland shrank by 9%.

Asia and in particular China saw good demand throughout the year, as did the US and Canada, while continental Europe ex-Germany was weaker. Saying that, 10 of Hays’ 17 other European markets still generated record fees so it wasn’t all doom and gloom.

As finance director Paul Venables says, Hays’ management is already taking steps to prepare for a downturn by ‘planning for the long term and executing for the short term’.

Therefore costs are being reduced where possible - including the first major senior-level restructuring in Europe since 2011 - as the company ‘right-sizes’ to suit the more competitive environment.

Getting it right now means that coming out of the downturn Hays will be a leaner and even more profitable business.