Business energy services company Inspired Energy (INSE:AIM) has revealed its sixth year straight of growth. Full year results reveal revenue up 42% to £42.5m and profits rising 38% to 7m, for year ending 31 December, 2016.

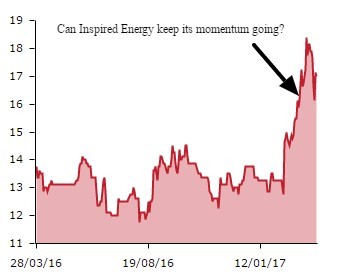

But despite impressive growth metrics the share price stubbornly refuses to budge, staying largely flat at 17p. At that level the company is trading on a price to earnings (PE) ratio of 11.3-times this year's anticipated 1.5p of earnings per share.

Shares reported earlier this month that Inspired Energy was trading at an unfair discount. That’s based on another year of 30%-plus earnings growth in 2016, plus pays dividends. The implied 3.1% 2017 yield this year looks generous for a growth stock of Inspired's calibre.

So it's understandable when the firm’s chief executive officer Janet Thornton is miffed.

‘We’ve been out there for five years and demonstrated growth,’ says Thornton. She adds that the firm has set out its strategy and delivered on what it said.

In terms of dividends, Thornton says ‘we’ve increased our dividend annually, twice in some cases’ and the results show this. Dividends were 0.11p in 2012 and have risen to 0.45p last year, a 29% increase on 2015.

Panmure Gordon analyst Michael Donnelly has a positive view on Inspired Energy, partly driven by the rising prices of energy which should increase demand.

But the firm’s share price has rocketed by 30% in just over a month so there’s a question mark over how much further it can grow.

Donnelly sets a target price of 21p, so clearly thinks that Inspired hasn’t run out of steam.

With mid and large cap businesses Travis Perkins and Victrex now signed up as clients, Inspired Energy has proved it can keep attracting bigger and bigger customers.

Its model is simple; it helps large corporates save money on energy prices and be more efficient when it comes to energy consumption.

The firm acquired Informed Business Solutions last September, giving it access to retail and leisure markets. It has acquired seven firms since inception and has around 12 possible targets in the pipeline so all going well, growth seems a certainty.

Aside from the large corporate clients which is the core business, Inspired Energy also has a small to medium size enterprise division.

It did so via acquisition again, most recently buying KWH Intelligent Energy, which focuses on larger SMEs energy procurement needs.

Donnelly concedes the firm’s shares have outperformed in recent months, yet says they trade on an unmerited 20% discount to the market.

For this reason, along with the counter-cyclical nature of energy firms themselves, it still appears a bargain.