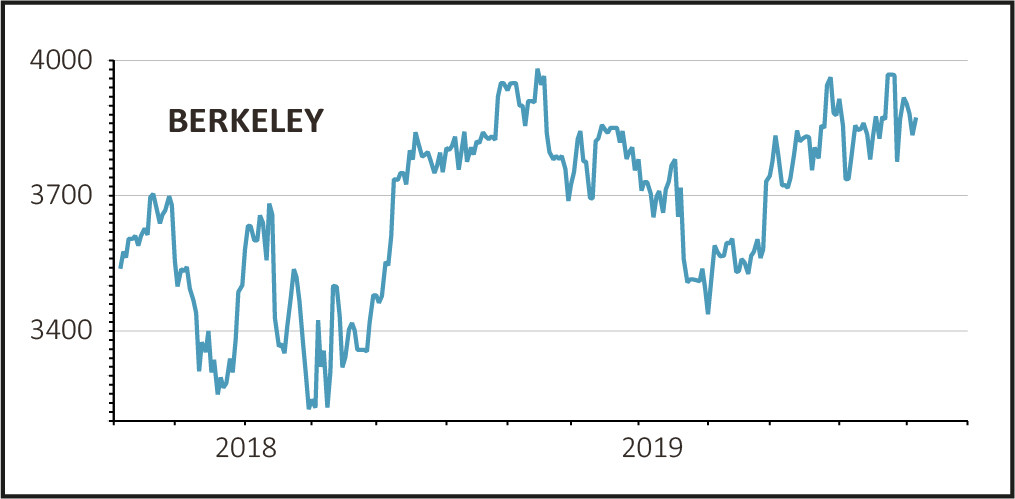

Housebuilder Berkeley Group (BKG) released a trading update for the period 1 May to 31 August, saying that market conditions in London and the South East remained ‘robust’ and consistent with those reported in the full year results in June. The market was relieved that conditions weren’t deteriorating and pushed the shares up 1.5% to £39.32.

While the company sees good underlying demand for new homes built to a high quality, the wider market remains constrained by high transaction costs and macro and political headwinds.

Adding to the positive sentiment today was the release of the Halifax price index, which showed that house prices in August were 1.8% higher than the same month last year, while the monthly change was up 0.3%.

READ MORE ABOUT BERKELEY GROUP HERE

LONG-TERM FOCUS

Berkeley is targeting the delivery of £3.3bn of pre-tax profit over the next six years to 30 April 2025, with annual profit in the £500m to £700m range.

This emphasises the company’s long-term focus on value creation over shorter-term annual changes in profits which can be dependent on the timing of deliveries.

Berkeley is working on over 20 of the largest residential opportunities in London and the South East, some of which will be delivered after 2030, but it has remained cautious in investing in new opportunities.

The company is therefore guiding that it expects its net cash at the half year stage (30 September) to be around £975m, similar to the full year position.

The housebuilder continues to address the risks associated with Brexit including accelerating the delivery of certain materials and components.

Berkeley also announced that the next six-monthly return of £139.7m (£1.11 per share) will be made by 31 March 2020, with the amount to be paid as a dividend to be announced before the end of February 2020, taking account of any share buy-backs in the intervening period.

Broker Shore Capital points out that the new guidance is at odds with the market expectations that annual profits would trend back to the £800m to £900m range. It goes on to say that the price earnings ratio of 12.5 times is a substantial premium to the sector’s large caps and close to double that of the solid and well-run mid caps such as Redrow (RDW) and Bellway (BWY).