It's Black Friday so retail stories are everywhere today. Yet online women’s fashion brand Sosandar (SOS:AIM) is one most investors will not have heard of.

The internet retailer arrived on the junior AIM market just a few weeks ago (2 November) with a £16.1m market value at the 15.1p per share issue price.

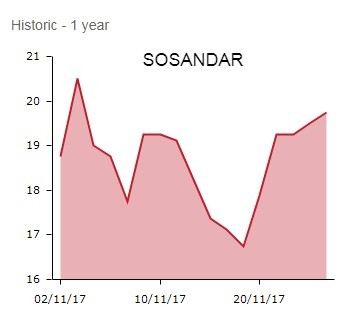

In the 22 days since then the stock has soared, rallying 24% on its first day of trading. The stock has bounced about a fair bit but at today's 19.5p the share price shows a 29% gain to date.

WHAT’S THE BULL CASE

The company is the brainchild of Ali Hall and Julie Lavington, the founders and joint CEOs. The pair have a long history of working together in the fashion business as editor and publishing director, respectively at fashion and celebrity style magazine Look.

Sosandar, which reversed into gold explorer-turned-cash shell Orogen earlier this month, has raised £5.3m of new money (before expenses). The new cash will be used to progress its product pipeline, raise brand awareness and strengthen the balance sheet.

UNDERSERVED DEMOGRAPHIC

The £20.8m cap’s products target an underserved demographic, the company says, looking to combine high quality, stylish and trendy clothing.

Hall and Lavington are positioning Sosandar as a one stop shop for ‘professional women who want affordable, affluent clothes'.

This means females who have graduated beyond price-led alternatives; think Boohoo (BOO:AIM) and ASOS (ASC:AIM), or privately-owned fashion website Missguided.

This high spend, underserved demographic currently spends £3.7bn a year on fashion and Sosandar’s subscriber base is on an upwards trajectory. This all augurs well with the UK online fashion market, valued at £16.2bn in 2017, predicted to grow to £29bn by 2022.

The fact that Yorkshire-based Clipper, a well-known logistics provider expecting a Black Friday business bonanza, is working with Sosandar, demonstrates this start-up brand could be big.

MORE CUSTOMERS

Sosandar has a growing customer base and social media following, supported by extensive media coverage both in the national press and on TV, well-known advocates of the company’s clothing range including Holly Willoughby.

And although Sosandar’s current focus is mainly on the UK market, as an online retailer, it is able to reach markets away from these shores.

Speaking to Shares recently, Hall and Lavington explained ‘we’ve got a diverse supplier base, we can scale with Clipper and we’ve got ambitions to be a multi-million pound business.'

This is admirable, although this is a share for adventurous, risk-tolerant investors rather than widows and orphans. Sosandar is tiny, sales for the 11 months to 31 July 2017 amounting to just £847,000.

AN INCREASINGLY CROWDED PLACE

Moreover, the UK online fashion retail scene is becoming increasingly crowded.

Hall and Lavington consider Mint Velvet to be Sosandar’s closest competitor in terms of target demographic, although Sosandar’s average price point is lower and is more trend-led, with more of a focus on dresses and workwear.

A further risk factor to consider is the potential for downward margin pressure due to a high level of returns seen in the online space and the increased logistical costs these returns bring.