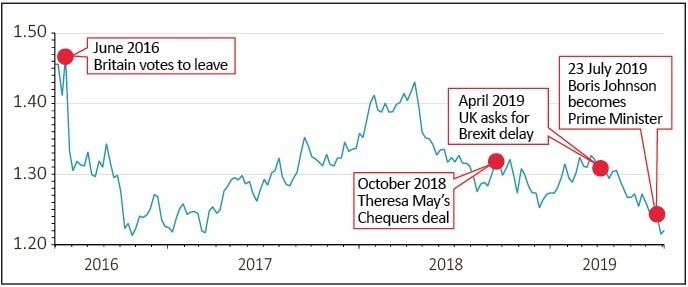

The pound is in freefall again as news breaks that Prime Minister Boris Johnson plans to ask the Queen to suspend Parliament just days after MPs return to work from their summer holiday in September.

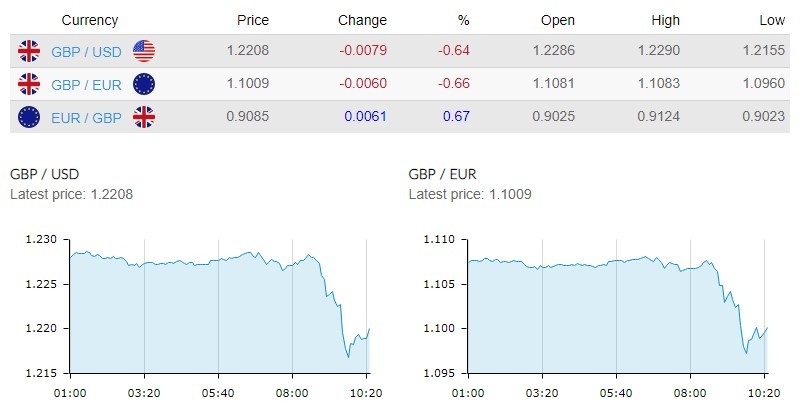

The pound is down more than 0.8% against both the dollar and the euro at 10.30am.

That means £1 is now worth $1.22 and €1.099, just fractionally above multi-year lows hit on 9 August, when sterling slumped to $1.2027 and €1.0737.

If Prime Minister Boris Johnson is successful in getting Parliament suspended it would make it increasingly difficult for no-deal opposition leaders to pass a law to stop a no-deal Brexit, cranking up the downside risk to the value of the pound.

BAKED-IN BAD NEWS

There’s already quite a lot of bad news baked-in to sterling’s valuation, but that’s not to say that the pound won’t plunge further, recently sparking bleak projections of a decline in the pound to 34-year lows if the UK leaves the European Union with no deal in place.

This stark warning emerged from a Bloomberg poll earlier this month. The survey of analysts at 13 banks found that the chances of a divorce without an agreement now stands at 30%, three-times the level of a similar survey in February. The impact of such an outcome could cut the sterling/dollar rate as low as $1.10, its lowest in a generation.

‘Politics should remain the key negative for sterling in the months to come,’ said analysts at investment bank ING, putting risk to the pound ‘heavily skewed to the downside.’

IMPACT ON INVESTORS

A weak pound makes imports like food, clothing and electrical goods, more expensive. It also increases the cost of petrol at the pump for millions of car-owning Brits.

For investors weak sterling is often seen as a positive thanks to the large percentage of UK company revenues and earnings that are imported from outside the UK. About 70% of FTSE 100 company earnings come from overseas.

Pound versus the dollar

It also makes UK companies cheaper for overseas buyers, upping the chances of takeovers of British brands, as has been seen with pubs group Greene King (GNK), defence contractor Cobham (COB) and pay-TV provider Sky.

On the other hand, a weak pound can lead to the drying up of investment flows into UK funds and stocks, arguably a key reason why the UK stock market continues to struggle to make meaningful headway versus strong gains seen elsewhere overseas.

‘We’re seeing a marked shift out of Britain and into mainland Europe by international fund managers,’ said Steven Holden, chief executive of Copley Fund Research. ‘The weakening pound is certainly the major contributor to the decline in UK stock allocations but it reflects caution over Brexit from an equity perspective too.’