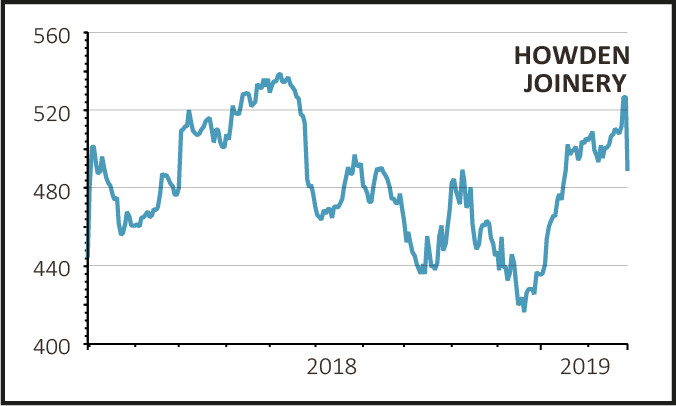

Shares in kitchen-maker Howden Joinery (HWDN) reverse their gains from earlier this week to trade down 8% at 482p as full year profits come in just shy of market estimates.

Sales are up 7.7% to £1.51bn in line with forecasts but gross margins are down due to increased costs and pre-tax profit of £238m is about £5m short of expectations.

We highlighted our concerns about pressure on profits back in November at the time of the third quarter results but in fairness the company says it saw an improvement in margins during the second half.

Trading for the first two months of 2019 has been encouraging with UK depot sales up 5.1% adjusted for one less trading day.

As well as eking out improvements generally across the business, Howden has been working on the design of its depots to make them more space-efficient.

As a result there is potential to open more, smaller depots in more locations, so the UK roll-out programme is being expanded to 850 sites which at the current rate of 35-40 a year means at least 4 more years of expansion.

Like Topps Tiles (TPT) the firm has been stock-piling raw materials in case of a no-deal Brexit and has built up £15m of inventory.

It has asked its suppliers to make sure they have plenty of stock and is looking at applying for Authorised Economic Operator status which would reduce delays at customs.

On the other hand it is shutting down its German and Dutch operations and focusing its European efforts just in France.